Electric Vehicle Battery Procurement Intelligence

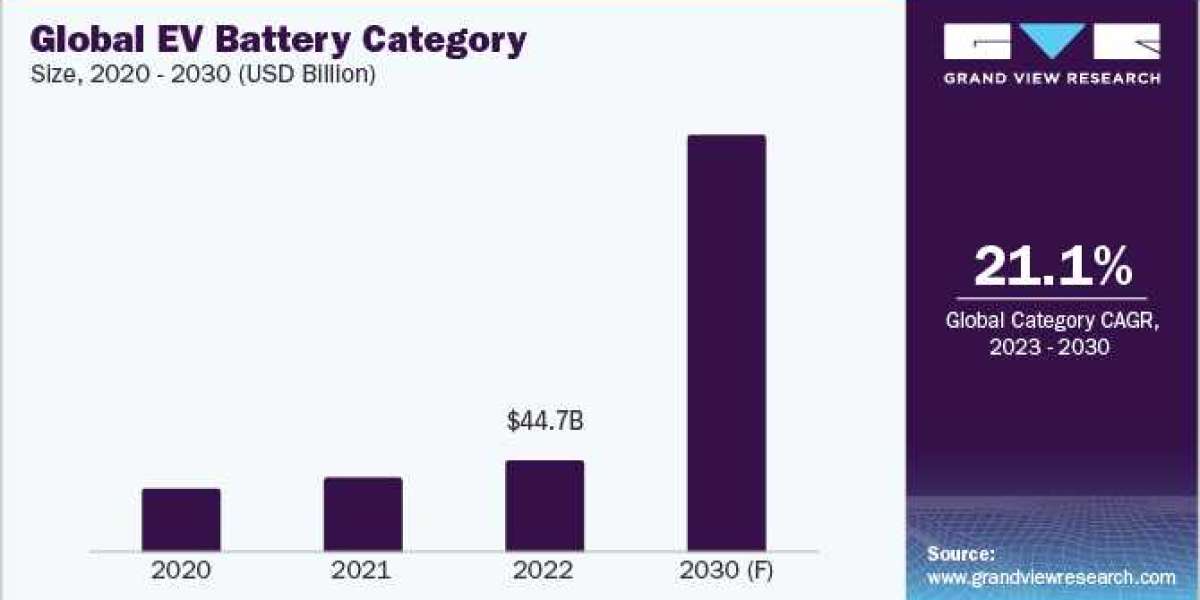

The electric vehicle battery category is expected to grow at a CAGR of 21.1% from 2023 to 2030. In 2023, the sales of BEVs and PHEVs surpassed those of hybrid electric vehicles (HEVs) worldwide. As a result, the requirement for a larger battery size in BEVs and PHEVs is in turn increasing the demand for batteries. IEA 2023 report states that battery demand in China increased by 70% and sales of EVs increased by 80% in 2022 compared to 2021. In the U.S. region, battery demand rose by 80% in 2022.

Critical materials are in greater demand due to the rise in battery demand. For instance, in 2022, lithium demand exceeded supply despite having a 180% increase in production levels since 2017. In 2022, the demand for lithium, nickel, and cobalt increased to 60%, 10%, and 30% respectively mainly for EV batteries. Lithium nickel manganese cobalt oxide topped the battery chemistry category in 2022 with around 59% to 61% of the total market share. As per IEA 2023 estimates, this was followed by lithium iron phosphate accounting for around 29% to 31% of the share. The third highest battery chemistry was nickel cobalt aluminum oxide (NCA) with a share of around 7% - 9% in 2022.

The category is moderately consolidated. Collaborative initiatives in battery development have been prioritized to address the challenges of performance, cost, and safety. For instance, IBM Research and Mercedes-Benz joined forces to create a battery that uses materials extracted from seawater. A few other developments include:

- In August 2023, Hyundai announced its USD 398 million investment in Korea Zinc. Through the strategic partnership, both companies will cooperate on the procurement of key materials for batteries. Jointly, they will establish a secure nickel supply chain first and then focus on other areas such as battery recycling. The deal aims to expand the battery materials business.

- In April 2022, CATL announced its partnership with PT ANTAM and IBI, Indonesia-based companies. The main aim of this deal was for the EV battery integration project and the joint investment was valued at USD 6 billion. The partnership included the processing and mining of nickel and other EV battery materials for manufacturing purposes. It would enhance CATL’s footprint, reduce manufacturing costs, and ensure a consistent supply of upstream raw materials and resources.

It has been found that in 2022 and 2023, Chinese OEMs have increased their preference for LFP batteries. Nearly 95% of the LFP batteries used in electric LDVs were manufactured in China in 2022. Out of this, BYD constituted around 50% of the total demand. Approximately 85% of the Tesla-manufactured cars using LFP batteries were made in China. The remaining automobiles were manufactured in the U.S. using cells that were imported from China.

Order your copy of the Electric Vehicle Battery category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

The high cost of importing batteries is one of the most significant difficulties that India faces. India presently imports almost all its battery cells from China, Japan, and South Korea, which raises the cost of producing electric vehicles in India. To tackle this problem, the Indian government has announced many incentives and plans to boost local battery manufacturing, including the Production Linked Incentive (PLI) scheme, which provides financial incentives to companies that manufacture sophisticated battery cells in India.

The key cost components include raw materials, energy, labor, packaging, depreciation, facilities and utilities, insurance, and marketing. Raw materials can account for 50% - 60% of the total cost structure. For a single EV battery, the important cost elements are-cathode, anode, manufacturing and depreciation, separators, electrolytes, housing, and other materials. Anode can constitute around 12% of the total cost. On average, cathodes are very expensive as the mineral composition in the cathode is responsible for the power, performance, thermal safety, and capacity of the battery. Cathode types include LFP, NMC, and NCA.

In 2022, the average battery price was around USD 150 per kWh. The cost of battery pack manufacturing accounted for 20% of the total cost. The costs of pack manufacturing have decreased by more than 5% in 2022 compared to 2021. Prices varied across different battery chemistries. For instance, in 2022, LFP battery prices increased by 25% owing to a rise in the prices of battery materials. In terms of battery production, China is the dominating nation worldwide. When procuring the category, it is important to ensure that manufacturers adhere to proper certifications, and production and emission guidelines. Suppliers are also evaluated on specified parameters such as battery capacity and discharge values, specified EV applications, power calculations, and operating ranges and temperatures.

Electric Vehicle Battery Sourcing Intelligence Highlights

- The electric vehicle battery category is moderately consolidated. Increasingly, vertical integrations are being opted by OEMs and battery suppliers to achieve a competitive edge.

- For a single EV battery cell, the major cost components include cathode, manufacturing and depreciation, anode, separators, electrolyte, and battery housings. Cathode forms the largest component, accounting for 51% of the total cost.

- The most preferred countries for procuring EV batteries are China, Japan, and South Korea.

- In terms of operating model, most of the end-user companies engage with their approved providers that meet their desired specifications for battery manufacturing.

List of Key Suppliers

- Contemporary Amperex Technology Co., Ltd. (CATL)

- LG Energy Solution

- BYD Company Ltd.

- Panasonic Corporation

- Samsung SDI Co., Ltd.

- SK Innovation Co., Ltd.

- Toshiba Corporation

- EnerSys, Inc.

- Mitsubishi Corporation

- Hitachi, Ltd.

- Tesla, Inc.

- Gotion High Tech Co Ltd (Guoxuan High-Tech)

Browse through Grand View Research’s collection of procurement intelligence studies:

- Catering Service Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Blockchain Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Electric Vehicle Battery Procurement Intelligence Report Scope

- Electric Vehicle Battery Category Growth Rate: CAGR of 21.1% from 2023 to 2030

- Pricing Growth Outlook: 15% - 20% (Annually)

- Pricing Models: Volume-based, contract-based

- Supplier Selection Scope: Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria: Production capacity, type of battery, battery capacity, propulsion, operational capabilities, quality measures, certifications, data privacy regulations, and others

- Report Coverage: Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions