Edge Computing Industry Overview

The global edge computing market size was valued at USD 16.45 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 36.9% from 2024 to 2030. Edge computing adds a layer of complexity to organizations by enabling a diverse set of stakeholders to maintain IT infrastructures, networking, software development, traffic distribution, and service management. Edge also combines software, hardware solutions, and networking architecture to cover various use cases in several businesses. Edge computing is currently in its early phases of development. Its deployment and operating models have yet to evolve; nonetheless, edge computing is expected to offer significant growth prospects for new entrants soon.

Businesses use possibilities to respond to the present situation by providing new services. The telecommunications industry is making rapid progress in video conferencing software like Microsoft Teams and Zoom and is creating new solutions to meet the growing demand.

Gather more insights about the market drivers, restrains and growth of the Edge Computing Market

Detailed Segmentation:

Application Insights

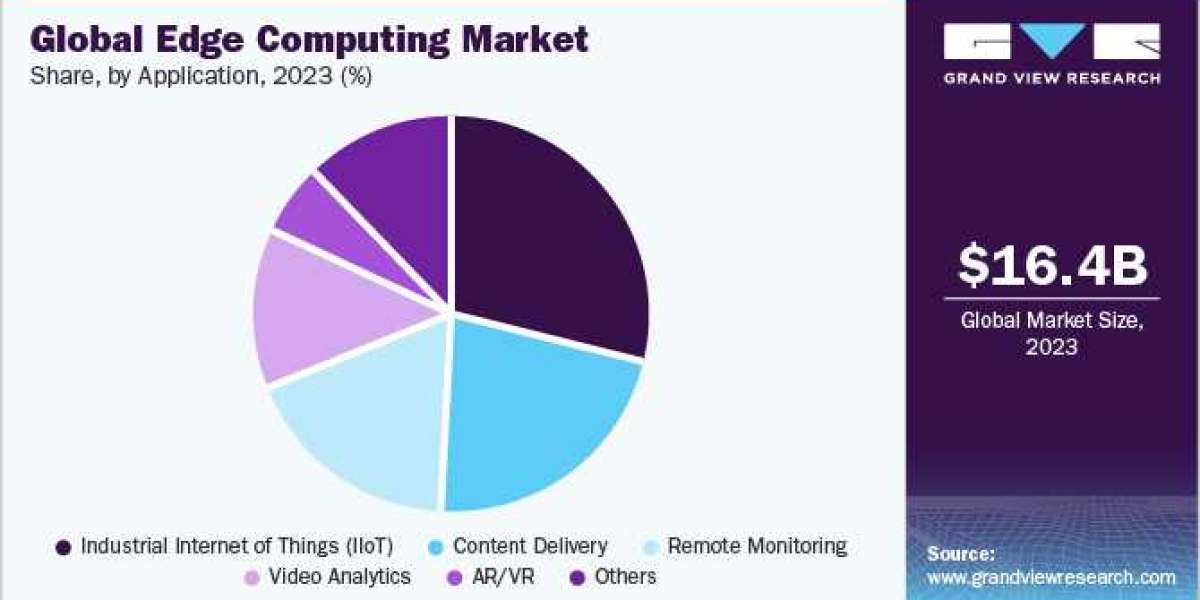

Based on application, the industrial internet of things (IIoT) segment dominated the edge computing market in 2023. Edge computing has played an important role in allowing manufacturers to reach the goal of digitization of their facilities. A significant stake in edge computing is installed in the form of device edge in the manufacturing segment. The demand for edge infrastructure is projected to increase as service intricacy rises and edge infrastructure becomes more accessible.

Component Insights

In terms of components, the hardware segment accounted for a major revenue share of more than 43% in 2023 . The demand for hardware is gaining steam in the managed services industry and is predicted to account for the most significant market share over the forecast timeline. As the number of IoT and IIoT devices grows quickly, the volume of data created by these devices is also increasing. Therefore, to deal with the volume of data created, enterprises are adopting edge computing gear to lessen the load on the cloud and data centers.

Industry Vertical Insights

The energy utilities segment accounted for a major revenue share of the market in 2023. Smart grids, which depend on device edge infrastructure, are likely to contribute to revenue growth in the energy and utility segment. Environmental sustainability initiatives are fueling efforts to improve electrical utility service efficiencies worldwide, including the development of alternative renewable power sources like solar and wind. Smart grids are being installed worldwide to enable capabilities and enhance operational efficiencies, including real-time consumption control, incorporation with smart appliances, and microgrids to support generation from dispersed renewable sources.

Regional Insights

North America region captured the largest revenue share of more nearly 40% in 2023. The convergence of IIoT with edge computing is forming favorable conditions for manufacturers in the U.S. to move toward connected factories. Several startups have also evolved to deliver platforms for developing edge-enabled solutions that are anticipated to boost the regional market's growth. For instance, Telus Communications and MobiledgeX, Inc. collaborated to build the MobiledgeX Early Access Programme. The program has allowed developers to build, test, and analyze the efficacy of edge-enabled applications in a low-latency environment.

Browse through Grand View Research's Category Next Generation Technologies Industry Research Reports.

- The global automated optical inspection systems market size was valued at USD 1.01 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 20.6% from 2024 to 2030.

- The global data protection as a service market size was valued at USD 22.05 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 25.9% from 2024 to 2030.

Key Edge Computing Companies:

The following are the leading companies in the edge computing market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Amazon Web Services (AWS), Inc.

- Aricent, Inc.

- Atos

- Cisco Systems, Inc.

- General Electric Company

- Hewlett Packard Enterprise Development

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Rockwell Automation, Inc

- SAP SE

- Siemens AG

Edge Computing Market Segmentation

Grand View Research has segmented the global edge computing market based on component, application, industry vertical, and region:

Edge Computing Component Outlook (Revenue, USD Million; 2018 - 2030)

- Hardware

- Hardware by Type

- Edge Nodes/Gateways (Servers)

- Sensors/Routers

- Others

- Hardware by End-Point Devices

- Cameras

- Drones

- HMD

- Robots

- Others

- Software

- Services

- Edge-Managed Platform

- Hardware by Type

Edge Computing Application Outlook (Revenue, USD Million, 2018 - 2030)

- Industrial Internet of Things (IIoT)

- Remote Monitoring

- Content Delivery

- Video Analytics

- AR/VR

- Connected Cars

- Smart Grids

- Critical Infrastructure Monitoring

- Traffic Management

- Assets Tracking

- Security Surveillance

- Smart Cities

- Others

Edge Computing Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

- Small Medium Enterprise

- Large Enterprise

Edge Computing Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

- Industrial

- Energy Utilities

- Healthcare

- Agriculture

- Transportation Logistics

- Retail

- Data Centers

- Wearables

- Government Public Sector

- Media Entertainment

- Manufacturing

- Telecom IT

- Others

Edge Computing Regional Outlook (Revenue, USD Million; 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- U.Germany

- K.

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East and Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Development

- In May 2023, Dell Technologies launched NativeEdge, an edge operations software platform. The platform is designed to help companies and businesses optimize and simplify secure edge deployments.

- In April 2023, Nokia launched four third-party applications for MX Industry Edge (MXIE). The application aims to help companies in analyzing data by connecting and collecting the data from operational technology assets in a secure on-premises edge.

- In October 2022, Amazon Web Services announced the public availability of the Amazon Elastic Compute Cloud Trn1 instance, which is powered by Trainium processors built by AWS. Trn1 instances are purpose-built for high-performance machine learning model training in the cloud, with up to a 50% cost-to-train reduction over equivalent GPU-based instances.

- In August 2022, Belden launched the Hirschmann OpEdge-8D device to advance Industrial Internet of Things connectivity in large, complex industrial networks by utilizing edge computing to utilize operational data better.