Neurovascular Devices Industry Overview

The global neurovascular devices market size was valued at USD 2.84 billion in 2022 and is anticipated to expand at a CAGR of 6.01% during the forecast period. The neurovascular devices market is likely to be driven by the increasing prevalence of neurological illnesses, technological developments, and increased demand for minimally invasive procedures.

Interventional neurology devices are used to diagnose and treat central nervous system and brain vascular disorders. Endovascular, catheter-based procedures, angiography, and fluoroscopy are all part of the interventional neurology. Catheter angiography is one of the oldest in-vivo brain vascular imaging techniques used to diagnose a variety of neurological diseases including cerebral aneurysm, arteriovenous malformations, intracranial stenosis, arteriovenous fistula, and vasculitis.

Gather more insights about the market drivers, restrains and growth of the Neurovascular Devices Market

Detailed Segmentation:

Device Insights

Cerebral embolization and aneurysm coiling devices held the largest market share of around 34.79% in 2022. Coil embolization is a minimally invasive procedure for the treatment of aneurysms, wherein, the material closes the sac and reduces the risk of bleeding. A steerable catheter is inserted through the groin and guided to the brain. Rising prevalence of aneurysm is expected to propel the segment during the forecast period. These devices are further classified into embolic coils, flow diversion devices, and liquid embolic agents.

Therapeutic Application Insights

Stroke held the largest market share of around 57.10% in 2022, owing to the factors such as increasing prevalence of hypertension, stroke, and other neurological disorders. According to the CDC, 1 in 6 people worldwide will have a stroke in their lifetime and every year, more than 795,000 people in the U.S have a stroke. Strokes are the second leading cause of death globally, and account for an approximate 140,000 deaths in the U.S annually. There are various initiatives undertaken by the government worldwide to prevention stroke. Some of the examples include, in October 2021, the Udall Center at the University of Minnesota Medical School received a new USD 11.3 million grant from the National Institute of Neurological Stroke.

Size Insights

0.021" held the largest market share of around 27.26% in 2022. Segment growth can be attributed to various advantages provided by the 0.021” devices, along with various product launches and product approvals. For instance, in April 2021, Bendit Technologies' 0.021" Bendit21 microcatheter has been cleared by the U.S FDA for use in the brain, peripheral, and coronary vasculature. The approval came several months after the Bendit21 microcatheter was successfully used in two life-saving surgeries in the U.S.

End-use Insights

Hospital held the largest market share of around 70.95% in 2022. The growth of this segment can be attributed primarily to the increasing patient pool suffering from neurovascular disorders, such as ischemic hemorrhagic stroke, brain aneurysm, Traumatic brain injury (TBI), and Arteriovenous Malformation (AVM). For instance, according to World Stroke Organization, throughout their lifetime, 1 in 4 persons over the age of 25 years is expected to experience a stroke. Every year, 13.7 million people are expected to experience their first stroke, and 5.5 million of them may die. Without suitable action, it appears that the annual death toll will increase to 6.7 million.

Regional Insights

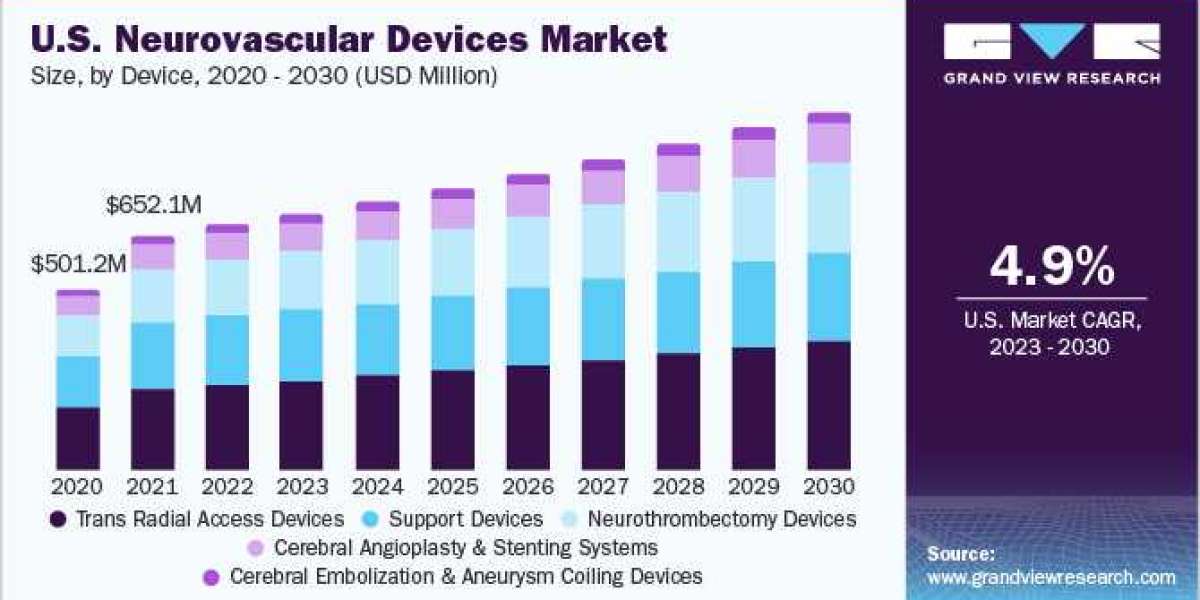

North America dominated the neurovascular devices market with the share of 26.44% in 2022 owing to the presence of key manufacturers such as Penumbra, Inc., Stryker Corporation, Johnson Johnson, and Merit medical systems, Inc. in the region. In February 2023, Phenox Inc. stated that their pRESET Thrombectomy Device has been cleared by the FDA for use in the treatment of acute ischemic stroke. The product pRESET, which has been marketed in Europe for more than a decade, has now been approved for use in the U.S. Furthermore, rising prevalence of neurological disorders, and increasing demand for the minimally invasive surgical procedures are driving the neurovascular devices market growth in this region.

Browse through Grand View Research's Category Medical Devices Industry Research Reports.

- The global ambulance stretchers market size was valued at USD 2.22 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.5% from 2024 to 2030.

- The global artificial hip and knee joints market size was estimated at USD 12.57 billion in 2023 and is projected to grow at a CAGR of 2.85% from 2024 to 2030.

Key Neurovascular Devices Companies:

Key market players are focusing on the launch of innovative types of medical devices, growth strategies, and technological advancements.

Some of the key players in global neurovascular devices market include:

- Medtronic

- Johnson and Johnson Services Inc.

- Penumbra, Inc.

- Microport Scientific Corporation

- Stryker

- Microvention Inc (Terumo Corporation)

- Codman Neuro (Integra Lifesciences)

Neurovascular Devices Market Segmentation

Grand View Research has segmented the global neurovascular devices market based on the device, therapeutic application, size, end use, and regions:

Neurovascular Devices Device Outlook (Revenue USD Million; Volume Unit; 2018 - 2030)

- Cerebral Embolization and Aneurysm Coiling Devices

- Embolic coils

- Flow diversion devices

- Liquid embolic agents

- Cerebral Angioplasty and Stenting Systems

- Carotid artery stents

- Embolic protection

- Neurothrombectomy Devices

- Clot retrieval devices

- Suction devices/aspiration catheters

- Vascular snares

- Support Devices

- Micro catheters

- Micro guide wires

- Trans Radial Access Devices

Neurovascular Devices Therapeutic Application Outlook (Revenue USD Million; 2018 - 2030)

- Stroke

- Cerebral Artery

- Cerebral Aneurysm

- Aneurysmal Subarachnoid Hemorrhage

- Others

- Others

Neurovascular Devices Size (in Inches) Outlook (Revenue USD Million; 2018 - 2030)

- 027"

- 021"

- 071"

- 017"

- 019"

- 013"

- 058"

- 068"

- Others

Neurovascular Devices End Use Outlook (Revenue USD Million; 2018 - 2030)

- Hospitals

- Specialty Clinics

- Others

Neurovascular Devices Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Norway

- Denmark

- Sweden

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.