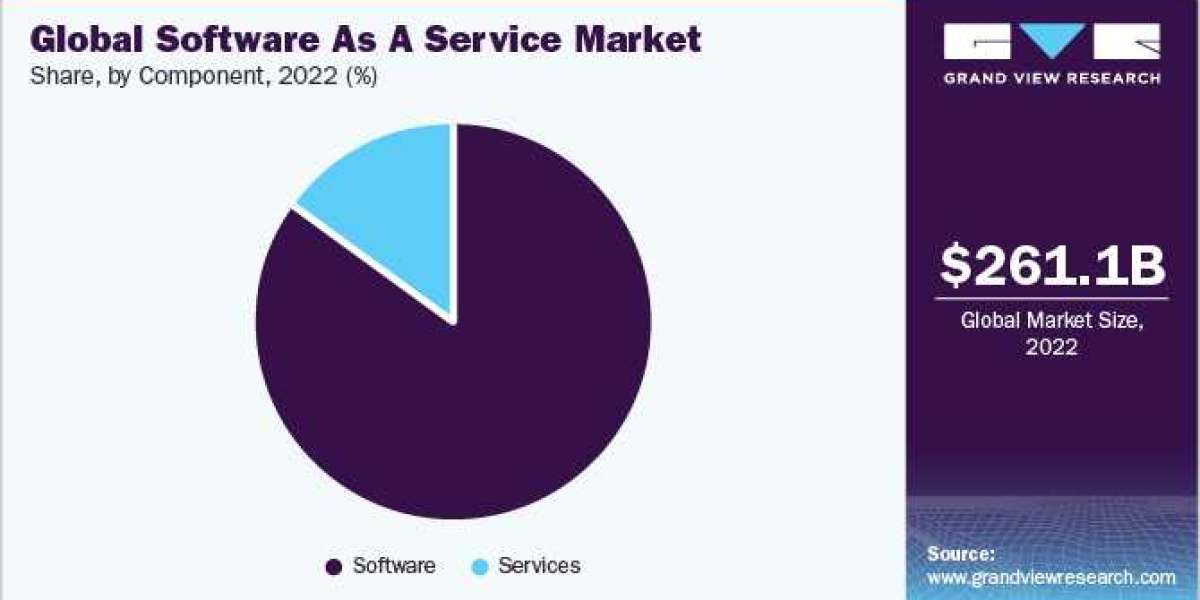

Software As A Service Industry Overview

The global software as a service (SaaS) market size was valued at USD 261.15 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.7% from 2023 to 2030. SaaS is a cloud service that provides software applications virtually through Internet. Rising adoption of public cloud services across enterprises is one of the major factors that propel the market growth. The growing shift of enterprises towards SaaS from an on-premises model owing to high cost of on-premises software deployment is further projected to propel the market growth. However, concerns related to data privacy and security related to public cloud is projected to hinder market growth.

Significant increase in the adoption of emails, instant messaging applications, and video calls encourages demand for smart devices among end-users and is projected to contribute to the growth of SaaS market. Furthermore, adoption of CRM SaaS solutions continues to rise as businesses seek to reduce their IT costs and improve scalability. Customization and configuration of CRM SaaS solutions are becoming easier and more accessible, allowing businesses to tailor their CRM systems to their specific needs, such as security. For instance, in December 2022, AppOmni announced a partnership with Veeva Systems to provide enhanced security for Veeva CRM and Veeva Vault. With this new offering, life sciences customers can access AppOmni's comprehensive threat detection and configuration management capabilities. Joint customers can operationalize best practices to protect sensitive data while ensuring regulatory compliance with AppOmni's Veeva integration.

Gather more insights about the market drivers, restrains and growth of the Software As A Service Market

Detailed Segmentation:

Component Insights

Software segment led the market in 2022 and accounted for a total revenue share of more than 84%. The pandemic has accelerated trends in remote work and flexible work arrangements, leading to a shift in employee expectations. As a result, many businesses are adopting SaaS solutions to enable remote collaboration, productivity, and communication. It includes tools for project management, video conferencing, and cloud storage. Additionally, there is a growing demand for SaaS solutions that offer automation and AI-powered insights to optimize workflows and increase efficiency. As digital transformation continues to accelerate across industries, businesses increasingly rely on data to expedite their operations and gain a better understanding of their customers or users. It has led to growing investment in analytics-driven SaaS solutions.

Deployment Insights

Private cloud segment held the largest revenue share of over 43% in 2022. Combining the deployment of SaaS applications at the network's edge with a private cloud infrastructure can provide organizations with greater control and security over their data while improving performance and reducing latency. Additionally, organizations can maintain greater control over their data by using a private cloud infrastructure, ensuring compliance with regulatory requirements, and mitigating risk of data breaches. Overall, combining edge computing with private cloud can provide a powerful platform for delivering SaaS applications that meet the needs of modern businesses.

Enterprise-size Insights

Large enterprises segment led the market in 2022, accounting for over 60% share of the global revenue. SaaS solutions offer large enterprises several benefits, including cost-effectiveness, scalability, and flexibility. A trend seen in large enterprises is adopting multi-cloud and hybrid-cloud strategies, driven by the need to manage complex distributed application environments that span multiple geographies, data centers, and cloud providers. Another trend observed among large enterprises is the adoption of platform-as-a-service (PaaS) solutions. PaaS solutions provide a higher level of abstraction than SaaS solutions, allowing enterprises to focus on application development and deployment rather than managing the underlying infrastructure. It can help large enterprises to accelerate their time-to-market, reduce development costs, and improve agility and innovation.

Application Insights

Others segment held the largest revenue share of over 42% in 2022. Others segment include supply chain management, security as a service, AI as a service, IoT as a service, edge computing, unified communications as a service, and operations management. Emergence of new technologies like robotic process automation (RPA), cloud computing, and artificial intelligence (AI) can potentially revolutionize supply chain software market. AI has the potential to transform supply chain management by providing real-time insights into inventory levels, demand forecasting, and delivery schedules. With increasing data availability and advanced analytics tools, AI will become a key enabler for supply chain optimization and agility.

Industry Insights

Others segment led the market in 2022, accounting for over 38% share of the global revenue. The other segment includes automobile and media entertainment industries. Further, BFSI segment accounted for over 24% share of the global revenue owing to the significant transformation in the sector, with new technologies and digital platforms disrupting traditional business models. Additionally, cloud-based core banking solutions are becoming increasingly popular as they offer greater flexibility and scalability than traditional on-premises solutions. These tools allow financial institutions to quickly adapt to changing market conditions, scale up or down as needed, and reduce costs

Regional Insights

North America dominated the market in 2022, accounting for over 44% share of the global revenue. The U.S. is positively contributing to the growth of market revenue. Presence of well-established market players is one of the driving factors for market growth. Moreover, developed IT infrastructure increases easy deployment of cloud-based virtual services in the region, further contributing to a significant share in the global software as a service (SaaS) market. Moreover, significant expenditure on cloud infrastructure and availability of many secured internet servers further contributed to the highest market share.

Browse through Grand View Research's Category Next Generation Technologies Industry Research Reports.

- The global AI agents market size was valued at USD 3.86 billion in 2023 and is expected to grow at a CAGR of 45.1% from 2024 to 2030.

- The global drone charging station market size was estimated at USD 0.43 billion in 2023 and is expected to grow at a CAGR of 6.5% from 2024 to 2030.

Key Software As A Service Companies:

Key market players tend to launch new strategies more frequently in order to stay head-on in the market. Moreover, companies are focusing on increasing investments in the advancement of cloud services to increase customer base in the market.

Some of the prominent players in the global software as a service (SaaS) market include:

- Adobe Inc.

- Microsoft

- Alibaba Cloud

- IBM

- Google LLC

- Salesforce, Inc.

- Oracle

- SAP SE

- Rackspace Technology, Inc.

- VMware Inc.

- IONOS Cloud Inc.

- Cisco Systems, Inc.

- Atlassian

- ServiceNow

Software As A Service Market Segmentation

Grand View Research has segmented the global software as a service market based on component, deployment, enterprise-size, application, industry, and region:

SaaS Component Outlook (Revenue, USD Billion, 2017 - 2030)

- Software

- Services

SaaS Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

- Public Cloud

- Private Cloud

- Hybrid Cloud

SaaS Enterprise-size Outlook (Revenue, USD Billion, 2017 - 2030)

- Small Medium Enterprises

- Large Enterprises

SaaS Application Outlook (Revenue, USD Billion, 2017 - 2030)

- Customer Relationship Management (CRM)

- Enterprise Resource Planning (ERP)

- Human Capital Management

- Content, Collaboration Communication

- BI Analytics

- Others

SaaS Industry Outlook (Revenue, USD Billion, 2017 - 2030)

- Banking, Financial Services Insurance (BFSI)

- Retail Consumer Goods

- Healthcare

- Education

- Manufacturing

- Travel Hospitality

- Others

SaaS Regional Outlook (Revenue, USD Billion, 2017 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- U.K.

- Asia Pacific

- China

- Japan

- India

- Singapore

- South Korea

- Malaysia

- Australia

- Central South America

- Brazil

- Middle East Africa

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.