Air Compressor Industry Overview

The global air compressor market size was valued at USD 25.46 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.7% from 2024 to 2030. Stringent environmental regulations and a growing emphasis on sustainability have led industries to adopt more environmentally friendly air compressors. Various industries in the Asia Pacific countries, such as manufacturing, oil gas, food beverage, energy medical, and home appliances have been enjoying significant growth through rising investments from public and private entities. China and India remain the most promising countries for upcoming sales and demand of air compressors owing to the presence of manufacturing hubs.

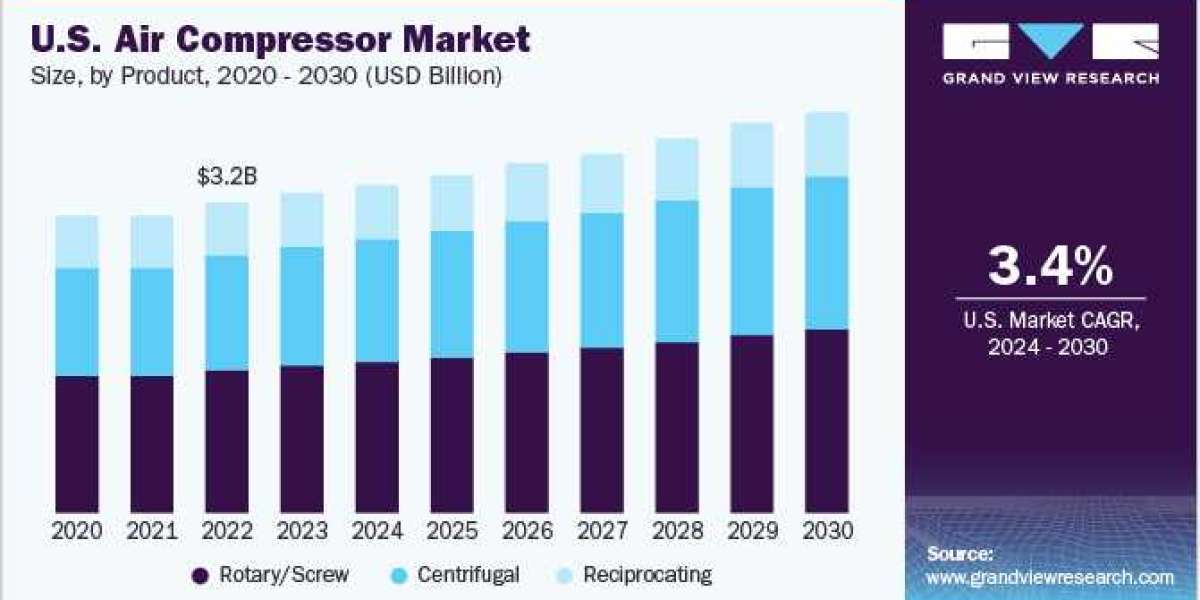

Various factors such as environmental concerns, strict regulations, industrialization, and the need for high-quality air in an industrial application have been prompting the growth of the demand for air compressors in the U.S. Air compressors are widely used in industries such as food beverage, pharmaceuticals, electronics, automotive, and healthcare.

Gather more insights about the market drivers, restrains and growth of the Air Compressor Market

Detailed Segmentation:

Type Insights

Based on type, the stationary air compressor segment led the market and accounted for the highest revenue share of 60.5% in 2023. The stationary air compressors are ideal for use in manufacturing plants, industrial plants, and auto repair shops. Furthermore, stationary air compressors are typically larger and more powerful than portable ones, which are suitable for heavy-duty applications.

Portable air compressors is likely to witness significant growth over the forecast period. They are available in various sizes and shapes. Smaller models are easy to transport whereas larger models are equipped with wheels for mobility. They are ideal for small-scale applications such as job sites and homes. The increasing concerns about environmental sustainability and reducing carbon footprints have led consumers and businesses to seek energy-efficient solutions, including portable air compressors, to lower energy consumption and emissions.

Lubrication Insights

Based on lubrication, the oil-filled air compressor segment led the market and accounted for the highest revenue share in 2023. An oil-filled air compressor, also known as an oil-lubricated air compressor, uses oil as a lubricant and coolant for its internal components, including the compressor pump. Oil-filled air compressors are commonly used in various industrial and commercial applications where clean, dry, and oil-free compressed air is not a strict requirement.

Oil-free air compressors are likely to witness significant CAGR growth over the forecast period. Oil-free mobile air compressors offer a wide range of advantages such as low risk of contamination, reduced maintenance and replacement cost, low energy cost, and minimal environmental impact, which is expected to drive the segment growth.

Application Insights

The manufacturing segment dominated the market in 2023. The growth of the manufacturing sector has indeed played a significant role in the expansion of the market. Manufacturing processes often require compressed air for various applications, such as operating pneumatic tools, controlling valves, powering machinery, and more.

Food beverage segment is expected to witness highest growth over the forecast period. Oil-free air compressors have gained popularity in the food beverage industry owing to their ability to provide clean, contaminant-free compressed air. Since oil can contaminate products and compromise their quality, the food beverage industry requires compressed air that is free of oil and other contaminants, resulting in a growing demand for oil-free air compressors in this industry.

Operating Mode Insights

Based on operating mode, the electric-operated air compressor segment dominated the market in 2023. Electric air compressors are versatile in terms of their energy efficiency, and it is one of the driving factors for use in various industries. Compared to their gasoline or diesel counterparts, electric compressors tend to be more energy-efficient, resulting in cost savings over time.

Power Range Insights

Based on power range, the 51-250kW segment held highest revenue share of in 2023, and is likely to grow at a significant CAGR over the forecast period. Air compressors in the 51 kW to 200 kW range offer several benefits due to their increased power and capacity. These compressors can provide a higher volume of compressed air, making them suitable for applications that require a significant amount of air, such as industrial manufacturing, large-scale construction, and mining.

Product Insights

Rotary/screw compressor segment dominated the market in 2023. The features of rotary/screw air compressors, such as low noise output, high energy efficiency, good performance, easy maintenance, and uninterrupted operation, are anticipated to attract more and more customers over the forecast period resulting in an increasing demand for rotary/screw air compressors.

Regional Insights

Asia Pacific led the market and accounted for the highest revenue share of 42.1% in 2023 and is anticipated to grow at the highest CAGR. China has a significant industrial sector with diverse applications that may drive demand for air compressors in the country. China is a major hub for electronics manufacturing, including the production of semiconductors, microchips, and other electronic components.

Browse through Grand View Research's Category Advanced Interior Materials Industry Research Reports.

- The global indium market size was valued at USD 1.03 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030.

- The global automotive interior materials market size was valued at USD 60.1 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.0% from 2024 to 2030.

Key Air Compressor Companies:

The market consists mainly of global players, of which a few operate regionally. New product launches, mergers and acquisitions, partnerships, and collaborations are vital strategies that companies adopt for sustained growth.

- Ansell Ltd

- Atlas Copco

- Strategic initiatives

- Bauer Group

- BelAire Compressors

- Cook Compression

- Compressor Products International (CPI)

- Frank Technologies

- Strategic initiatives

- Galaxy Auto Stationary Equipment Co. Ltd.

- Gast Manufacturing, Inc.

- GE Energy, Heyner

- Hitachi Industrial Equipment Systems Co. Ltd.

- Hoerbiger, Ingersoll Rand Plc

- Kaeser Compressors

- MAT Industries, LLC

Air Compressor Market Segmentation

Grand View Research has segmented the global air compressor market based on type, product, lubrication, application, and region:

Air Compressor Type Outlook (Revenue, USD Billion; Volume, Units 2018 - 2030)

- Stationary

- Portable

Air Compressor Product Outlook (Revenue, USD Billion; Volume, Units 2018 - 2030)

- Reciprocating

- Rotary/Screw

- Centrifugal

Air Compressor Lubrication Outlook (Revenue, USD Billion; Volume, Units; 2018 - 2030)

- Oil Free

- Oil Filled

Air Compressor Application Outlook (Revenue, USD Billion; Volume, Units 2018 - 2030)

- Healthcare Medical

- Manufacturing

- Oil Gas

- Home Appliances

- Food Beverage

- Energy

- Semiconductor Electronics

- Others

Air Compressor Air Compressor Operating Mode Outlook (Revenue, USD Billion; Volume, Units; 2018 - 2030)

- Electric

- Internal Combustion Engine

Air Compressor Power Range Outlook (Revenue, USD Billion; Volume, Units; 2018 - 2030)

- Up to 20 kW

- 21-50kW

- 51-250 kW

- 251-500 kW

- Over 500kW

Air Compressor Regional Outlook (Revenue, USD Billion; Volume, Units 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Central South America

- Brazil

- Argentina

- Middle East Africa

- Saudi Arabia

- South Africa

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In August 2023, FS Elliot Co., LLC introduced the P400HPR Centrifugal Air Compressor. The P400HPR ensures energy efficiency and dependability while meeting any high-pressure application with improved features and exceptional performance. Some prominent players in the air compressor market include.

- In April 2023, Atlas Copco announced the acquisition of the compressed air business division of Asven S.R.L., a specialist in the service, installation, and sales of compressed air systems.