Casino Management System Industry Overview

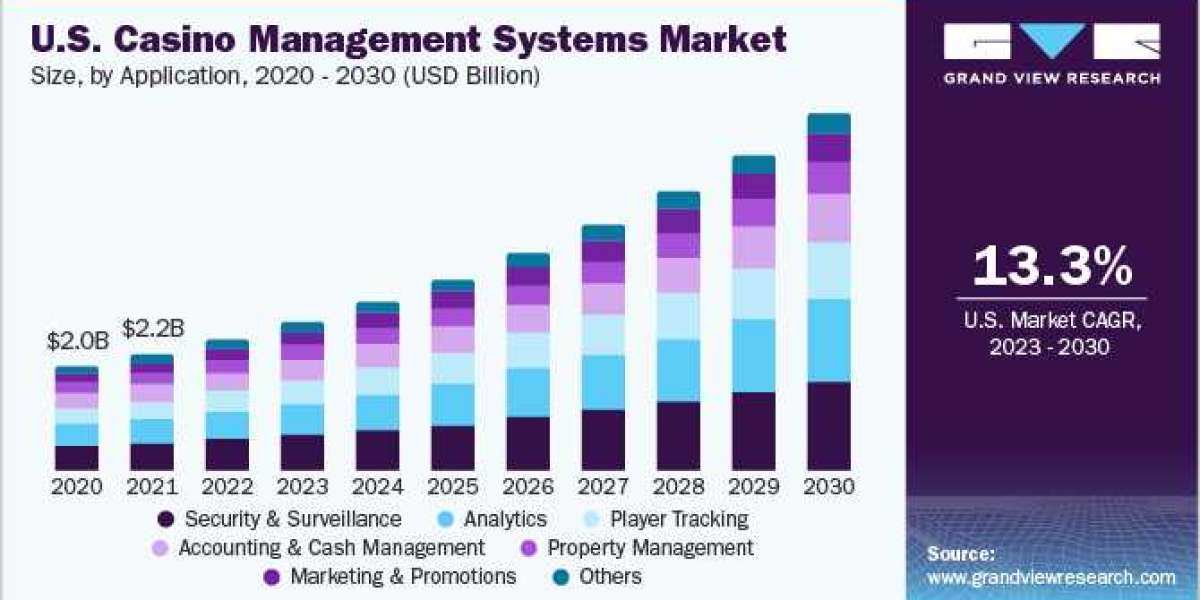

The global casino management systems market size was valued at USD 7.16 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.9% from 2023 to 2030. The surging demand for innovative technologies in the gaming industry is expected to spur the demand for casino management systems. The increasing legalization and rising number of gaming establishments are projected to be critical factors positively impacting market growth in the near future. Additionally, the growing number of gambling clubs worldwide is paving the way for the growth of the casino management systems market. For instance, according to the American Gaming Association (AGA), the number of gaming clubs in the U.S. stood at 979 in 2018. Thus, the U.S. accounted for the highest number of casinos in the world.

The industry has been witnessing significant changes over the past few years in terms of technology, and gaming experience offered to patrons. Casinos are heavily reliant on customer retention and focus on improving the quality of services in a bid to deliver a much more personalized experience. Gaming clubs incorporate a variety of disparate systems that collect a wide range of data on customers and floor operations. Casino management systems offer a centralized system to collect data from various systems enabling gaming club operators to streamline their operations and enhance the customer retention rate.

Gather more insights about the market drivers, restrains and growth of the Casino Management System Market

Detailed Segmentation:

Application Insights

The security and surveillance segment accounted for the largest revenue share of 23.4% in 2022. Surveillance systems for gaming clubs are designed to mitigate cheating, theft, and other crimes around the gambling club floor as well as the entire resort. Video surveillance solutions enable operators to streamline floor operations to remain profitable. Advancements in automated security systems are also expected to fuel the demand over the forecast period.

Casinos involve a lot of monetary transactions that attract a lot of fraud and spoof attacks leading to increased adoption of security and surveillance systems. Such systems incorporate a variety of technologies such as facial recognition, license plate readers, and other analytics to enable operators to prevent fraud, stealing, and cheating on the gambling club floor. Organizations offering casino management solutions are constantly trying to enhance and implement new technologies to overcome security challenges. Offering a safe and secure gaming environment is of primary concern for gaming club operators driving the adoption of security and surveillance solutions.

Regional Insights

North America dominated the casino management systems market and accounted for the largest revenue share of 41.8% in 2022. Technological proliferation and the highly saturated casino industry are the key factors influencing the growth of casino management systems in the region. The increasing adoption of casino management systems to enhance operational efficiency, and customer retention, and to gain a competitive edge will boost market growth over the forecast period.

Asia Pacific is expected to grow at the fastest CAGR of 16.8% during the forecast period. This can be attributed to the rapid increase in disposable income, evolving consumer preferences, and improving social acceptance of gambling clubs. Furthermore, easing government regulations to support gaming clubs across the region is also anticipated to bolster regional growth. Additionally, tax contribution benefits are also expected to spur the demand for casino management systems over the forecast period.

Browse through Grand View Research's Category Next Generation Technologies Industry Research Reports.

- The global 3D projector market size was valued at USD 3.72 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 10.0% from 2024 to 2030.

- The global physical identity and access management market size was valued at USD 1.07 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 15.3% from 2024 to 2030.

Key Casino Management System Companies:

Market players are focusing on inorganic growth strategies, such as acquisitions mergers, and collaborations, to augment their market share.

- IGT.

- Konami Gaming, Inc.

- Light Wonder, Inc.

- LGS

- Honeywell International, Inc.

- Aristocrat

- Next Level Security Systems, Inc.

Casino Management Systems Market Segmentation

Grand View Research has segmented the global casino management systems market based on application and region

Casino Management Systems Application Outlook (Revenue, USD Million, 2017 - 2030)

- Security Surveillance

- Analytics

- Accounting Cash Management

- Player Tracking

- Property Management

- Marketing Promotions

- Others

Casino Management Systems Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In December 2022, Rivers Casino Portsmouth joined Rush Street Gaming's use of Konami Gaming's SYNKROS casino management system. The new casino, which opened in Portsmouth was Rush Street's fifth facility to use SYNKROS.

- In November 2022, NOVOMATIC AG, a gaming technology company based in Austria acquired a majority position in HBG Group, an Italian gaming concessionaire and technology provider. NOVOMATIC becomes one of the largest concessionaires in Italy and one of Europe's most important gaming marketplaces with this acquisition.

- In October 2022, Light Wonder, Inc. the U.S.-based company in cross-platform games announced the acquisition of loyalty marketing software provider, House Advantage. The acquisition helped Light Wonder to expand its loyalty platform and offer a more comprehensive suite of solutions to its customers.

- In May 2022, Galaxy Gaming a manufacturer of casino table games and technology launched Triton Casino Systems, an all-new table game improved operating system. Triton Casino Systems is an advanced version of the company's previous system, the Bonus Jackpot System, and incorporates several additional features that improve the casino floor.

- In May 2022, IGT, the U.S.-based gaming company, expanded its presence in Asia by signing a deal with Nustar to provide its Advantage Casino Management System (CMS) to a new casino resort in the Philippines. Through this deal Nustar would offer IGT's "Resort Wallet," and deploy Peak49 cabinet in its upcoming casino resort.

- In August 2021, Everi Holdings and Konami Gaming collaborated to pair Konami's SYNKROS casino management system with Everi's CashClub Wallet. This collaboration enables operators who use SYNKROS to provide their customers with Everi's flexible, cost-effective funding and payment solution.