Population Health Management Industry Overview

The global population health management market size was estimated at USD 70.0 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 22.0% from 2024 to 2030. The medical industry is rapidly transforming to digitization from a paper-based system, increasing demand for healthcare IT services. In addition, increasing demand for solutions supporting healthcare providers has resulted in a shift from Fee-For-Service (FFS) to Value-Based Payment (VBP) models. Rising demand for effective disease management strategies is expected to boost market growth.

Population health management system assists as a patient-friendly platform that aids in cost-controlling of treatment. In addition, the platform assists service providers and payers with risk management related to reimbursement policies. In recent years, healthcare system has evolved significantly and has become more patient-centered.

Gather more insights about the market drivers, restrains and growth of the Population Health Management Market

Detailed Segmentation:

Product Insights

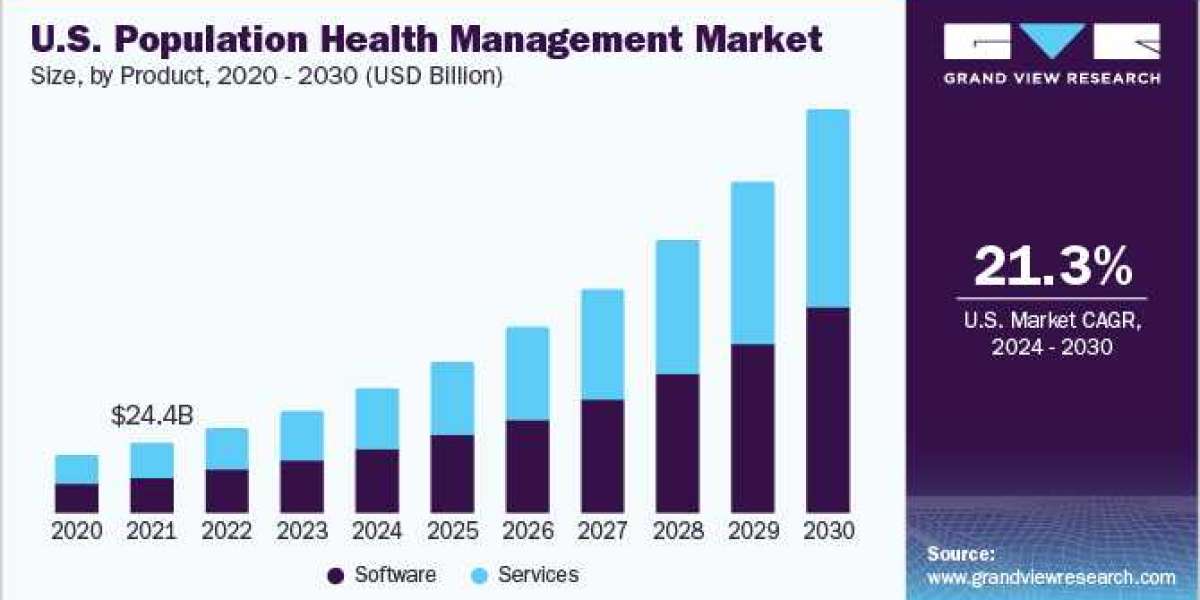

Based on product, market is segmented into software and services. In 2023, services segment gained a major market share of 51.6%. Demand for PHM services is increasing among hospitals and other healthcare organizations to involve third parties to assess patient data. Need for integrated healthcare systems is also responsible for increasing demand for PHM services.

Besides, rising RD investment by manufacturers to launch innovative products has supported healthcare organizations to a major extent. For instance, in December 2022, Morris Heights Health Center (MHHC), a healthcare center launched a partnership with Garage, a population health management technology company, under which health center will use a platform to improve care in the Bronx community for 50,000 patients.

Company’s Garage’s Software as a Service population health management platform “Bridge” is designed to connect care teams and providers to facilitate patient information exchange, secure messaging, patient tracking communication, referral management, clinical integration, clinical intelligence, clinical data management, and clinical analytics.

Delivery Mode Insights

Based on delivery mode, market is segmented into On-Premise and Cloud-based. Cloud-based segment held the largest market share of 71.9% in 2023 and is anticipated to register the fastest CAGR over the forecast period. In addition, a cloud-based population health management suite improves processes with cutting-edge data integration technologies and advanced analytics, further benefiting end-user to meet their population health management requirements.

In addition, cloud-based platform assists with workflow automation, improved care management, and coordination with better clinical results. Likewise, cloud-based segment has witnessed its highest demand during the COVID-19 pandemic benefiting market growth.

End-use Insights

Healthcare providers segment held a revenue share of 48.0% in 2023, owing to improved clinical outcomes by aiding in better disease management, resulting in reduced in-patient stays and minimized observation hours of physicians. Healthcare providers are increasingly investing in population health management to offer better outcomes. It can be used to track discharged patients’ vital signs, which can then be analyzed to provide insights into patient’s health.

Furthermore, the pandemic has helped healthcare providers to offer physicians an integrated electronic medical record (EMR) to collect data from patients and create registries. This factor has supported providers to focus on patient care and reduce overall costs.

Payers are ideally third-party entities that reimburse or finance health services costs. This competitive advantage has led to increasing demand for PHM software for payers and is expected to propel segment growth over forecast period.

Regional Insights

North America dominated the market and is anticipated to grow lucratively throughout forecast period with a revenue share of 46.2% in 2023. Growth is driven by reduced medical costs, cloud computing, regulatory scenarios, rising use of information technology in healthcare, and increasing disease prevalence. Furthermore, in this region, the U.S. is one of the primary hubs that offer commercialized PHM services, with more than 100 companies operating in region. High potential of market is attracting new players into region and simultaneously, existing players are making value-based additions to their current offerings to create new opportunities in market.

Asia Pacific’s market is anticipated to witness fastest growth throughout forecast period due to developing healthcare infrastructure and rising healthcare expenditure. Furthermore, chronic disease incidence is expected to double from 2001 to 2025 in the Asia Pacific region. For managing data generated from these increased incidences of chronic diseases, advanced data analytics will be required, which is expected to boost market growth.

Browse through Grand View Research's Category Healthcare IT Industry Research Reports.

· The global post-marketing pharmacovigilance and medical information market size was valued at USD 5.60 trillion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.5% from 2024 to 2030.

· The global medical animation market size was valued at USD 396.2 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 20.1% from 2024 to 2030.

Key Companies Market Share Insights

Companies' strategic initiatives to strengthen their market presence include mergers and acquisitions, providing customized solutions, and business partnerships with other key players. Furthermore, as part of their commercialization strategies, companies are investing significant sums of money in developing new products and platforms with enhanced and improved features.

- For instance, in January 2023, Gainwell Technologies was awarded a USD 600 million contract by the California Department of Health Care Services as part of the CalAIM initiative for population health management services.

- In October 2022, MEDITECH introduced Expanse Population Insight, a population health management product. The product is supported by the Innovaccer Data Platform and offers data aggregation and curation along with care delivery and data analytics.

Key Population Health Management Companies:

- Veradigm LLC

- Oracle

- Conifer Health Solutions, LLC

- eClinicalWorks

- Enli Health Intelligence (Cedar Gate Technologies)

- McKesson Corporation

- Medecision

- Optum, Inc.

- Koninklijke Philips N.V.

- Athenahealth, Inc.

- Welltok (Virgin Pulse)

Population Health Management Market Segmentation

Grand View Research has segmented the global population health management market based on product, delivery mode, end-use, and region.

Population Health Management Product Outlook (Revenue, USD Million, 2018 - 2030)

- Software

- Services

Population Health Management Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

- On-Premise

- Cloud-based

Population Health Management End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Providers

- Payers

- Employer Groups

Population Health Management Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Sweden

- Norway

- Denmark

- Asia Pacific

- Japan

- China

- India

- Australia

- Thailand

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Middle East Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.