5G Services Industry Overview

The global 5G services market size was valued at USD 84.31 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 59.4% from 2023 to 2030. 5G wireless mobile services enable a fully mobile and connected environment by delivering a wide range of use cases and business models to consumers. Moreover, faster data speeds and extremely low latency offered by 5G technology would enhance the user experience while using 5G services for several use cases, such as Virtual Reality (VR) and Augmented Reality (AR) gaming, seamless video calling, and Ultra-High Definition (UHD) videos, among others. Growing demand for high-speed data connectivity for unified Internet of Things (IoT) applications, such as smart home energy management, is estimated to propel the adoption of these services over the forecast period.

Moreover, the rising focus on building partnerships by 5G system integration providers with telecom operators is estimated to augment the adoption of these services. Many industry verticals are focusing on technological transformations along with 5G forums for information sharing to improve their overall productivity and operational efficiency as part of efforts to sustain in a highly competitive environment. 5G wireless technology holds the potential to help in realizing remarkable transformations across all these verticals through reductions in overall costs and enhancement in productivity.

Gather more insights about the market drivers, restrains and growth of the 5G Services Market

Detailed Segmentation:

Communication Type Insights

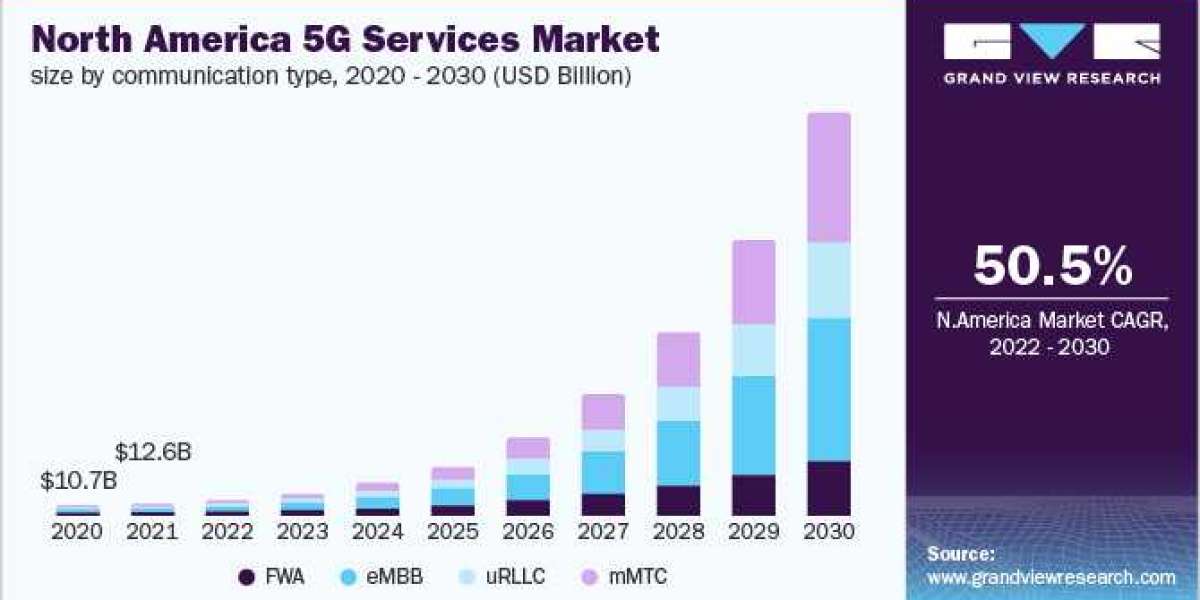

Enhanced Mobile Broadband (eMBB) segment dominated the market with a share of more than 40% in 2022 and is expected to grow considerably over the forecast period. The high share is attributed to the preliminary focus by 5G network operators on delivering enhanced broadband capabilities for applications, such as high-speed cloud-based gaming, AR/VR, UHD video, and uninterrupted video calls. The initial phase of the rollout is expected to focus on a 5G wireless non-standalone deployment model. eMBB provides extremely high data speeds for residential and commercial use.

Vertical Insights

The enterprise segment led the market in 2021 and held the largest revenue share of 94.0%. The segment is expected to continue its dominance over the forecast period due to significant investments by key players in the latest technologies for communication. The growing demand for higher data speeds for residential and commercial applications is estimated to drive the growth of the IT telecom segment over the forecast period. 5G services are expected to deliver ubiquitous broadband access between homes and offices, which would encourage remote consultation with specialists and reduce business travel. The growing need for enhanced broadband capacity for virtual business meetings is anticipated to propel the segment growth during the forecast period.

Regional Insights

Asia Pacific led the market in 2022 with a share of over 40% and is estimated to expand further at the fastest CAGR during the forecast period. Key market players in APAC, such as China Telecom, China Mobile, SK Telecom, and KT Corp., are investing aggressively in rolling out 5G network infrastructure in China, Japan, and South Korea. Most of these investments are for the deployment of next-generation infrastructure for media entertainment, transportation logistics, healthcare, and manufacturing industry verticals. These investments are estimated to propel the growth of the Asia Pacific regional market over the forecast period. Moreover, the high demand for smartphones supporting higher data speeds has resulted in robust production of 5G-enabled smartphones across the region.

Browse through Grand View Research's Category Next Generation Technologies Industry Research Reports.

- The global centralized refrigeration systems market size was estimated at USD 29.87 billion in 2023 and is projected to grow at a CAGR of 5.0% from 2024 to 2030.

- The global education and learning analytics market size was valued at USD 7.09 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 23.3% from 2024 to 2030.

Key 5G Services Companies:

The global market is highly fragmented as several regional telecom service providers are investing in deploying next-generation infrastructure. The company plans to utilize the spectrum to provide next-generation improved internet services in the U.K. Key players in the global 5G services market include:

- ATT, Inc.

- British Telecommunications plc

- China Mobile Ltd.

- China Telecom Corporation Ltd.

- Bharti Airtel Limited

- KT Corp.

- Saudi Telecom Company

- Vodafone Group Plc

- Deutsche Telekom AG

- SK Telecom Co., Ltd.

- Verizon Communications, Inc.

- NTT DOCOMO

- T-Mobile USA, Inc.

- Rakuten Mobile Inc.

5G Services Market Segmentation

Grand View Research has segmented the global 5G services market on the basis of communication type, vertical, and region:

5G Services Communication Type Outlook (Revenue, USD Billion, 2020 - 2030)

- FWA

- eMBB

- uRLLC

- mMTC

5G Services Vertical Outlook (Revenue, USD Million, 2020 - 2030)

- Consumer

- Enterprises

- Manufacturing

- Public Safety

- Healthcare Social Work

- Media Entertainment

- Energy Utility

- IT Telecom

- Transportation Logistics

- Aerosapce Defense

- BFSI

- Government

- Retail

- Mining

- Oil Gas

- Agriculture

- Construction

- Real Estate

5G Services Regional Outlook (Revenue, USD Billion, 2020 - 2030)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Russia

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East Africa (MEA)

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Developments

- In June 2023, ATT, Inc.and Cisco Systems, Inc. entered into a strategic collaboration aimed at assisting businesses in enhancing connectivity to meet the growing needs of a workforce that relies heavily on mobile devices. Together, these companies are looking forward to providing SD-WAN connectivity along with additional services, such as 5G and broadband, ensuring that businesses of all scales can experience an optimized and seamless experience.

- In June 2023, Vodafone UK merged with Three UK for creating one of Europe’s best in class 5G network service with reliability, great coverage, and high-speed data connectivity.

- In June 2023, T-Mobile USA Inc. collaborated with the City of Bellevue to jointly launch a network-based Cellular Vehicle-to-Everything (C-V2X) technology. This technology along with T-Mobiles’s 5G network service will provide real-time communication between traffic infrastructure, vulnerable road users, and cars.

- In June 2023, BT Group Plc partnered with Lyca Mobile for providing customers of Lyca with cost-effective mobile connectivity of 4G and 5G radio access network.

- In April 2023, Deutsche Telekom AG announced a partnership with Amazon Web Services, a provider of cloud computing platforms. The partnership falls under the Integrated Private Wireless on AWS program, which envisages combining AWS services with private wireless solutions based on LTE and 5G technologies from the campus network portfolio of Deutsche Telekom AG.

- In April 2023, ATT, Inc. initiated plans to expand 5G standalone technology service by including MIMO, and carrier aggregation technologies for improving data rates, signal quality, and overall performance.

- In March 2023, SK Telecom Co., Ltd. Collaborated with Dell Technologies for the launch of a 5G mobile edge computing (MEC) solution. MEC is a significant technology for 5G services including immersive media, autonomous driving, and smart factories.