Mining Automation Industry Overview

The global mining automation market was valued at USD 4.90 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.3% from 2023 to 2030. The rapid advancement in technology, such as Artificial Intelligence (AI) and robotics, has resulted in increased usage of mining automation solutions as a means of boosting production efficiency. The increasing trend of deploying innovative technologies is driving the growth of automated mining solutions. The emergence of the Internet of Things (IoT) in this sector offers mine management with real-time data and analytics with the help of visualization tools. Several operators are teaming up with technology companies to deploy wireless networks underground.

For instance, in April 2021, International Business Machines Corp. (IBM) announced the acquisition of myInvenio, an Italian startup company. The Company builds and operates process mining software. The initiative aims to MyInvenio’s process and task mining technology into IBM Cloud for Robotization, a platform for structuring and running robotization operations. The company will benefit from the data-driven software and tools that help them track sales, production, procurement, and accounting. The increasing need for mine and worker safety is providing an impetus to industry growth. Previously, the traditional mining techniques have compromised the safety of the mine workers resulting in increased hazards at the mining site.

Gather more insights about the market drivers, restrains and growth of the Mining Automation Market

Detailed Segmentation:

Solution Insights

The software automation segment dominated the market in 2022 and accounted for a share of more than 42.10% of the global revenue. Furthermore, the equipment automation segment is expected to show significant growth over the forecasted period. The development of robust technology-based vehicles, such as autonomous trucks, remote control equipment, and teleoperated mining equipment, is expected to fuel the segment's growth. Rapid advancements in hardware automation technology are expected to persistently streamline the way large-scale mining is undertaken across the globe.

Rio Tinto is a U.K.-based mining and metals company in the production of copper, minerals, iron ore, and aluminum. It has deployed nearly 400 Autonomous Haulage Systems (AHS)-enabled haul trucks at the Pilbara mine in Australia. In addition, the company is estimated to expand its driverless truck program by retrofitting Caterpillar Inc. trucks and 29 Komatsu Ltd. haul trucks for Brockman 4 mining operation, allowing the mine to run entirely in driverless mode. Furthermore, teleoperated mining equipment, such as wireless sensors, cameras, and Radio Frequency Identification (RFID), materials have emerged as common applications in the mining industry.

Application Insights

The mineral mining segment dominated the market in 2022 and accounted for the largest share of more than 34.85% of the global revenue. The metal mining application is presumed to show significant growth over the forecast period. The growth can be attributed to the increased convention of autonomous technology in metal exploration activities. Moreover, the rising demand for metals, such as copper, zinc, lead, and nickel, by application industries is expected to contribute to revenue growth. Furthermore, metal mining witnessed a surging demand for automated solutions to meet the rising demand for base metals.

For instance, in February 2022, UltimateSuite, a SaaS company, provided Task Mining results for automated business process analysis. It announced the launch of Robotic Process mining software on its platform to improve task discovery. The new extension helps its clients to automatically distinguish duplicative tasks, which can be automated or simplified to maximize effectiveness and boost business return on investment. The company’s software produces data, including the frequency of the task, total time spent on an activity, and the number of users. It also processes it to identify actions based on repetitious patterns, which can be excluded, simplified, or automated to make cost savings. The coal mining segment is expected to have a significant share. The increasing need to improve the mining conditions at coal sites has contributed to deploying autonomous solutions at the site.

Regional Insights

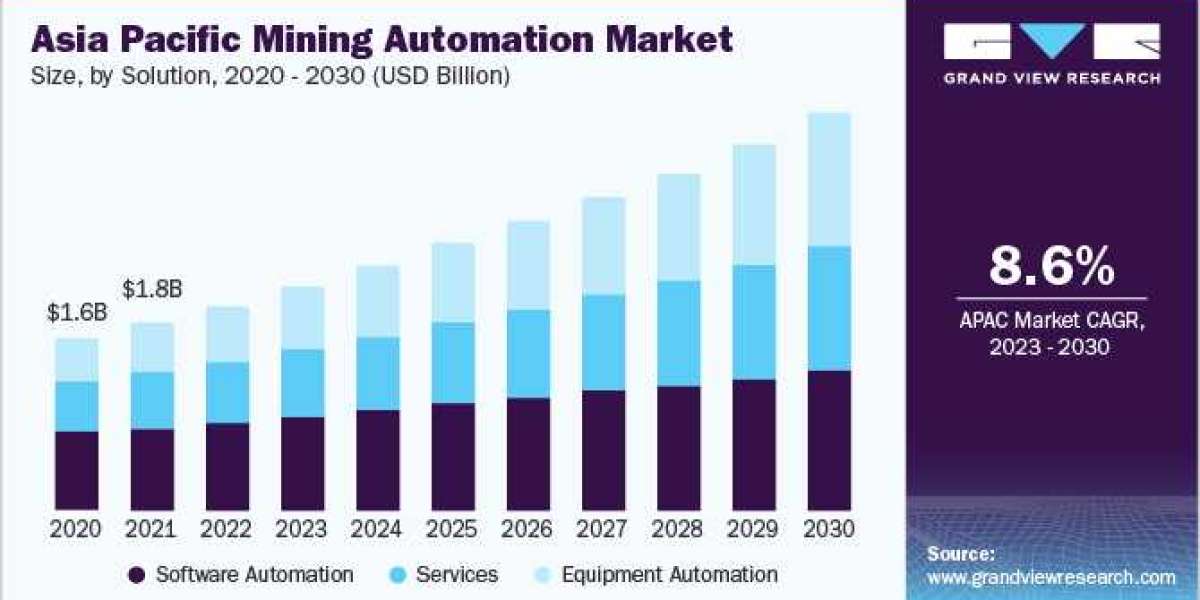

Asia Pacific dominated the industry in 2022 and accounted for over 39.75% of the overall revenue share. Increased adoption of automation technology in Australia is presumed to drive the regional market. The Australian economy witnesses the use of robots and remote-controlled equipment for the extraction of minerals safely and efficiently. The untapped drilling and exploration potential in economies, such as China and India, are expected to provide substantial opportunities for growth over the forecast period. For instance, in 2022, Sandvik AB acquired Deswik, an Australian company that offers a wide range of mining-integrated software and consulting solutions.

It includes operations planning, mining data management, computer 3D mine designs, and geological mapping. The initiative aims to pack a value chain gap in the mining sector and Rock solutions' offering. North America is expected to be a promising region due to the presence of high growth potential in the U.S. and Canada. The mines in Alberta, Canada have deployed autonomous haul trucks from Komatsu Ltd. to unearth and transport the oil sands for processes into crude oil. Moreover, growing opportunities for mineral exploration, resources, and infrastructure are increasing in the MEA region with the increasing government initiatives in Africa.

Browse through Grand View Research's Category Next Generation Technologies Industry Research Reports.

- The global AI agents market size was valued at USD 3.86 billion in 2023 and is expected to grow at a CAGR of 45.1% from 2024 to 2030.

- The global drone charging station market size was estimated at USD 0.43 billion in 2023 and is expected to grow at a CAGR of 6.5% from 2024 to 2030.

Key Mining Automation Companies:

The players focus on offering autonomous solutions that provide benefits, such as productivity and cost efficiency, in mining operations.

Some of the prominent players in the global mining automation market include:

- Atlas Copco AB

- Autonomous Solution Inc.

- Caterpillar

- Epiroc AB

- Hexagon AB

- Hitachi, Ltd.

- Komatsu Ltd.

- Liebherr Group

- MST (Mine Site Technologies)

- Rio Tinto

- Rockwell Automation, Inc.

- RPM Global Holdings Ltd.

- Sandvik AB

- Siemens

- Trimble Inc.

Mining Automation Market Segmentation

Grand View Research has segmented the global mining automation market based on solution, application, and region:

Mining Automation Solution Outlook (Revenue, USD Million, 2018 - 2030)

- Software Automation

- Services

- Implementation Maintenance

- Training

- Consulting

- Equipment Automation

- Autonomous Trucks

- Remote Control Equipment

- Teleoperated Mining Equipment

Mining Automation Application Outlook (Revenue, USD Million, 2018 - 2030)

- Metal Mining

- Mineral Mining

- Coal Mining

Mining Automation Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- Canada

- U.S.

- Europe

- Germany

- U.K.

- Asia Pacific

- Australia

- China

- India

- Japan

- Latin America

- Brazil

- Mexico

- Middle East Africa

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.