Preclinical CRO Industry Overview

The global preclinical CRO market size was valued at USD 5.72 billion in 2023 and is anticipated to grow at a CAGR of 8.7% from 2024 to 2030. Increased RD budget for drug development is leading to rising demand for preclinical contract research organization (CRO) services, thus boosting the market growth during the forecast period. The surge in the number of preclinical trials involving large molecules and the growing need to curb RD expense is expected to contribute to the growing demand for quality preclinical CRO.

Gather more insights about the market drivers, restrains and growth of the Preclinical CRO Market

With regards to the COVID-19 vaccine, preclinical studies have been performed at an exponential speed, indicative of the overwhelming role of CROs. Increasing spending on CRO services is expected to boost the market growth significantly during the forecast period. The growing demand for drugs post COVID-19 is further contributing to the market growth. Different organizations across the globe have made significant funding for developing therapeutics and medical devices post COVID-19. For instance, the U.S. federal government allocated around USD 2.3 billion towards RD of mRNA COVID-19 vaccines from the onset of the pandemic in 2020 through March 2022.

Over the years, there has been a significant change in the process of drug approval by the Food and Drug Administration (FDA). Recently, the 21st Century Cures bill was passed in the U.S., which fastened the approval process for the launch of breakthrough drugs and medical devices. These changes in approval processes are expected to drive innovation and are also anticipated to increase demand for preclinical services, thereby contributing to market growth.

Furthermore, demand for CROs is increasing due to rising RD expenditure and growing focus of pharmaceutical companies on cost containment. Biopharmaceutical companies choose to outsource their early development RD functions to CROs to reduce product development time and costs. This trend is expected to continue over the forecast period due to the increasing capabilities of CROs to conduct complex research, which enables life sciences companies to reduce RD expenditure focus on their core activities.

Browse through Grand View Research's Medical Devices Industry Research Reports.

- The global clinical trials market size was valued at USD 80.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.49% from 2024 to 2030.

- The global ATP assays market size was estimated at USD 3.31 billion in 2023 and is projected to grow at a CAGR of 7.9% from 2024 to 2030.

Preclinical CRO Market Segmentation

Grand View Research has segmented the global preclinical CRO market based on service, model type, end-use, and region:

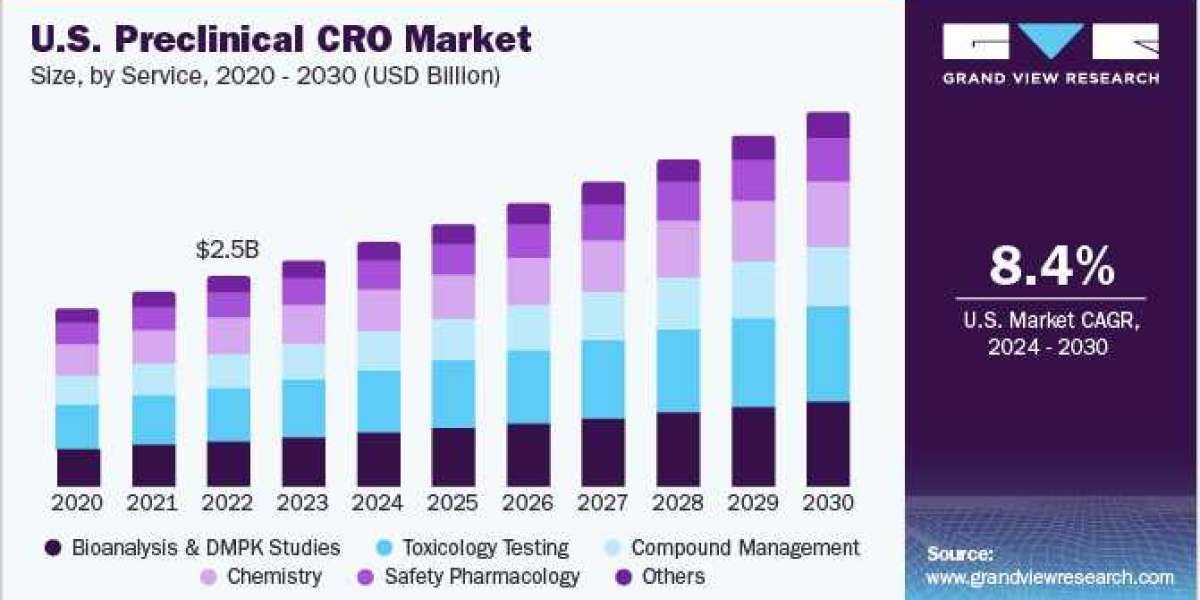

Preclinical CRO Service Outlook (Revenue, USD Billion, 2018 - 2030)

- Bioanalysis and DMPK studies

- In vitro ADME

- In-vivo PK

- Toxicology Testing

- GLP

- Non-GLP

- Compound Management

- Process RD

- Custom Synthesis

- Others

- Chemistry

- Medicinal Chemistry

- Computation Chemistry

- Safety Pharmacology

- Others

Preclinical CRO Model Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Patient Derived Organoid (PDO) Model

- Patient derived xenograft model

Preclinical CRO End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Biopharmaceutical Companies

- Government and Academic Institutes

- Medical Device Companies

Preclinical CRO Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Sweden

- Norway

- Denmark

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Key Companies profiled:

- Eurofins Scientific

- PRA Health Sciences, Inc.

- Wuxi AppTec

- Medpace, Inc.

- Charles River Laboratories International, Inc.

- PPD (Thermo Fisher Scientific, Inc.)

- SGA SA

- Intertek Group Plc (IGP)

- LABCORP

- Crown Bioscience

Key Preclinical CRO Company Insights

The preclinical CRO market has both large, multinational CROs and smaller, specialized CROs. These include Labcorp, Charles River Labs, Eurofins Scientific, and Intertek Group. Preclinical CRO market share depends on several factors such as number of players in the market, service portfolio, therapeutic expertise, geographic reach, innovation investments, as well as partnerships collaborations. For instance, key companies such as Covance— Labcorp’s drug development business,provide a comprehensive suite of preclinical services, including pharmacology safety assessment, vector cell characterization qualification, and biodistribution testing services. These market players also have expertise in specific therapeutic areas or in emerging fields (e.g., immuno-oncology, gene therapy). Combined with a broad geographic reach these companies can offer clients access to diverse patient populations, regulatory environments, and research expertise.

Recent Developments

- In March 2023, Crown Bioscience JSR Life Sciences Company announced starting a new site in Singapore, which will support the company in expanding its capacity for local and global biotech pharma companies. The site will support companies that engage in preclinical translational oncology drug discovery and development.

- In February 2023, Apax Partners acquired Porsolt, a recognized Global CRO. This partnership will enhance Porsolt’s service offering while expanding its product portfolio capabilities for drug screening, safety, and efficacy for worldwide consumers.

Order a free sample PDF of the Preclinical CRO Market Intelligence Study, published by Grand View Research.