Automotive Electronics Industry Overview

The global automotive electronics market size was valued at USD 262.60 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.8% from 2024 to 2030. The increasing integration and implementation of advanced safety systems such as automatic emergency braking, airbags, parking assistance systems, and lane departure warning to decrease road accidents is expected to favor demand over the forecast period. Moreover, features such as emergency call systems, alcohol ignition interlocks, and accident data recorder systems are rapidly adopted to safeguard in-vehicle passengers and are expected to drive market growth over the forecast period.

Gather more insights about the market drivers, restrains and growth of the Automotive Electronics Market

The increasing demand for electric vehicles is driving the demand for automotive electronics. Many people are switching from fuel ignited vehicles to electrics vehicles, and this is increasing the demand for systems. It has increased the demand for battery management systems and electric powertrains of electric vehicles. However, apart from the growing demand for electric vehicles, government regulations and funding have also impacted positively the automotive electronics market growth.

Government imposed safety regulations which made automakers around the world improve the safety of vehicles and reduce the number of accidents on the roads, which boosts the demand for automotive electronics. Government safety regulations can also be used to support the development of new technologies, such as electric vehicles, which can improve efficiency and reduce emission from vehicles. For instance, China has laid down regulations focusing on reducing energy consumption of passenger cars and maximizing the sales of new energy vehicles, including plug-in hybrid and fully electric cars. Governments across various countries are providing annual tonnage tax and automobile tax to promote the use of electric vehicles.

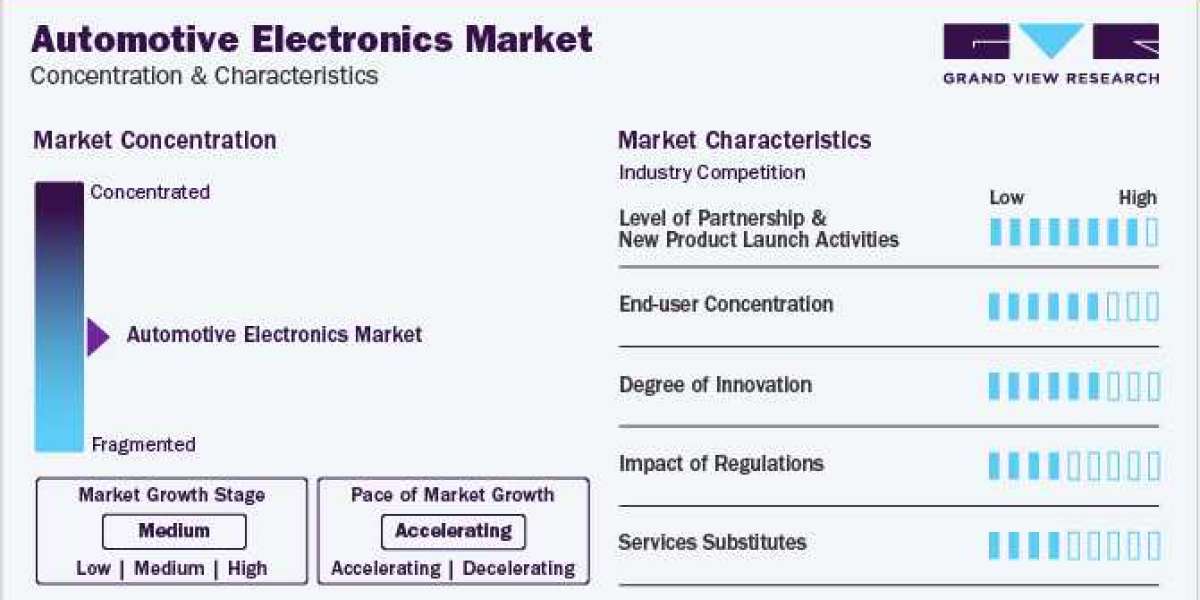

Technological advancements have positively impacted the growth of automotive electronics. Advancements in areas such as automotive powertrain electronics, autonomous driving, and connected vehicles. The automotive electronics market forms an essential part of the automotive industry, which provides automakers and goods with efficient and sustainable automotive electronics solutions. The market for automotive electronics is likely to remain focused for industry players and policymakers as urbanization and the demand for automotive vehicles continue to grow.

Parking assistance, electrical suspensions, braking, and steering systems are some of the critical systems incorporated in luxury cars and mid-size cars. Furthermore, the government promotes the adoption of zero-emission vehicles and imposes obligatory safety standards for automotive manufacturers. Governments are also regulating the use of ADAS safety system installations in vehicles. For instance, the New Car Assessment Program mandates advanced active and passive safety systems in China and Europe. Also, the Indian government allows specific low-frequency band usage to help automotive manufacturers use radar-based systems to install ADAS features in vehicles. All these factors are driving the growth of the automotive electronics market.

Browse through Grand View Research's Automotive Transportation Industry Research Reports.

- The global automotive battery market size was valued at USD 48.71 billion in 2016. The market is expected to witness significant growth over the coming years owing to rapid expansion in the automotive industry in emerging economies such as Mexico, Vietnam, Indonesia, India, and Thailand.

- The global apparel logistics market size was estimated at USD 54.96 billion in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030.

Automotive Electronics Market Segmentation

Grand View Research has segmented the global automotive electronics market based on component, application, vehicle type, propulsion, sales channel, and region:

Automotive Electronics Component Outlook (Revenue, USD Million, 2018 - 2030)

- Electronic Control Unit

- Sensors

- Current Carrying Devices

- Others

Automotive Electronics Application Outlook (Revenue, USD Million, 2018 - 2030)

- ADAS

- Infotainment

- Body Electronics

- Safety Systems

- Powertrain Electronics

Automotive Electronics Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

- Two Wheeler

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Automotive Electronics Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

- ICE

- Electric

Automotive Electronics Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

- OEM

- Aftermarket

Automotive Electronics Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- UAE

- Saudi Arabia

- South Africa

Key Companies profiled:

- Continental AG

- DENSO Corporation

- Hella GmbH Co. Kgaa

- Hitachi Automotive Systems, Ltd.

- Infineon Technologies AG

- Robert Bosch GmbH

- Valeo Inc.

- Visteon Corporation

- Xilinx, Inc.

- ZF Friedrichshafen AG

Key Automotive Electronics Company Insights

- Denso Corporation is an automotive supplier offering electrification, powertrain, mobility, thermal, and electronic systems to carmakers across the globe. The company focuses on developing core technologies in four fields, namely automated driving, electrification, connected driving, and factory automation.

- ZF Friedrichshafen AG is engaged in delivering active and passive safety technology for commercial vehiclesand passenger cars. It operates through seven divisions, namely Car Chassis Technology, Car Powertrain Technology, Industrial Technology, Commercial Vehicle Technology, Active Passive Safety Technology, e-Mobility, and ZF Aftermarket. The company has a presence in 230 locations across 40 countries globally.

- Visteon Corporation, Hitachi Automotive Systems Ltd., MotoLink, and iElektron are some of the emerging market participants in the automotive electronics market.

- Hitachi Automotive Systems Ltd. is engaged in development, manufacturing, sale, as well as service of industrial machines and systems, transportation related components, and automotive components in Japan and globally. It delivers engine management systems such as fuel systems, control units, intake and exhaust systems, ignition systems, engines, and sensors.

Recent Developments

- In March 2023, Infineon Technologies AG expanded its partnership with Delta Electronics, Inc., an energy, and power management company that would deepen its innovative activities to provide higher density and more efficient solutions for the growing market of electric vehicles. With partnership would provide EV drivetrain applications such as on-board chargers, DC-DC converters, and traction inverters, along with a wide range of components such as low-voltage and high-voltage microcontrollers and discrete as well as modulus.

- In January 2023, ZF Friedrichshafen AG announced the introduction of Smart Camera 6, a next-generation camera for automated driving and safety systems. The main focus of Smart Camera 6 is to fulfill the demand for 3D surround view and Interior Monitoring Systems with the support of Image Processing Module systems.

- In January 2023, Xilinx, Inc. collaborated with an embedded AI autonomous driving provider, Motovis to provide a solution that combines Motovis’ convolutional neural network (CNN) IP and Zynq system-on-chip (SoC), Xilinx Automotive (XA) platform for forward camera systems' vehicle control and perception in the automotive industry. The aim of the solution is to enhance customers with robust platforms and rapid development.

- In October 2022, Hitachi Automotive Systems, Ltd. developed a 360-degree stereo vision system with a multi-camera 3D sensing prototype for automated vehicles traveling on road. The prototype is integrated into a single in-vehicle camera system with high accuracy, cost advantage, and high resolution.

Order a free sample PDF of the Automotive Electronics Market Intelligence Study, published by Grand View Research.