Telemedicine Industry Overview

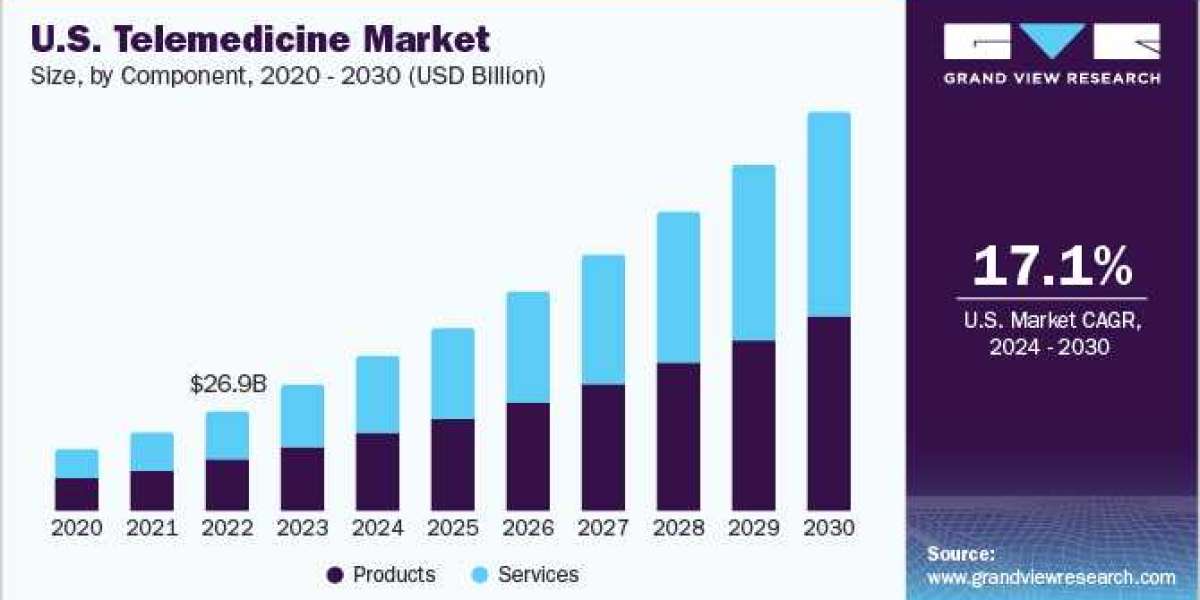

The global telemedicine market size was valued at USD 114.98 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 17.96% from 2024 to 2030.

The telemedicine market growth is being driven by factors such as consolidation across industry, strategic initiatives by key companies, and increasing healthcare consumerism. Furthermore, rising adoption of telemedicine by providers, increasing patient acceptance and consumer demand, and delivery of improved quality of care are expected to contribute to the growth of the telemedicine market over the forecast period. For instance, in May 2021, Walmart Inc. acquired a telehealth company, MeMD. This acquisition is expected to enable Walmart to expand its offerings and provide virtual access to primary, urgent, and behavioral healthcare services nationwide.

Gather more insights about the market drivers, restrains and growth of the Telemedicine Market

COVID-19 pandemic has resulted in a significant increase in adoption of telemedicine to reduce the risk of infection by minimizing contact between patients, healthcare facilities, and staff. Health authorities and mental health professionals in China have utilized online mental health surveys and communication programs, including Weibo, TikTok, and WeChat, to provide effective and safe mental health services during the pandemic, leading to expansion of telemedicine market. In March 2020, SOC Telemed, witnessed a surge in requests for on-demand acute care delivered through telemedicine. This emphasizes rising need for its services during the pandemic and capability of telemedicine to provide remote care in urgent situations. In addition, in October 2022, the Union Ministry of Health Family Welfare of India launched the National Tele Mental Health Programme (Tele MANAS) to strengthen mental health service delivery in the country.

According to statistics published by the GSM Association report, The Mobile Economy 2022, in 2021, number of people mobile users was 5.3 billion, and number of unique mobile subscribers is expected to reach 5.7 billion by 2025 (70% of the global population). In addition, penetration of smartphones is rising significantly. As per The Mobile Economy 2022, smartphone penetration was 75% in 2021 and is expected to reach 84% by 2025. Rising adoption of smartphones by consumers is driving growth of telemedicine market. Furthermore, growing network coverage and continuous advancement in network infrastructure are boosting the demand for telemedicine services.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

- The global lung cancer screening software market size was valued at USD 24.6 million in 2023 and is projected to grow at a CAGR of 6.9% from 2024 to 2030.

- The global cancer registry software market sizewas valued at USD 75.8 million in 2023 and is projected to grow at a CAGR of 12.7% from 2024 to 2030.

Telemedicine Market Segmentation

Grand View Research has segmented the global telemedicine market based on component, modality, application, delivery mode, facility, end-use, and region:

Telemedicine Component Outlook (Revenue, USD Billion, 2018 - 2030)

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

Telemedicine Modality Outlook (Revenue, USD Billion, 2018 - 2030)

- Store and forward

- Real time

- Others

Telemedicine Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

Telemedicine Delivery Mode Outlook (Revenue, USD Billion, 2018 - 2030)

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

Telemedicine Facility Outlook (Revenue, USD Billion, 2018 - 2030)

- Tele-hospital

- Tele-home

Telemedicine End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Providers

- Payers

- Patients

- Others

Telemedicine Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North Americ

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Key Companies profiled:

- MDlive, Inc. (Evernorth)

- American Well Corporation

- Twilio Inc.

- Teladoc Health, Inc.

- Doctor On Demand, Inc. (Included Health)

- Zoom Video Communications, Inc.

- SOC Telemed, Inc.

- NXGN Management, LLC

- Plantronics, Inc.

- Practo

- VSee

Key Telemedicine Company Insights

- MDLive Inc. is a telehealth and on-demand healthcare provider with services that cater to patients, hospitals, healthcare providers, employers, etc. The virtual care cloud-based platform of the company allows easy collaboration between providers and patients, bridging the gap in care delivery.

- American Well Corporation is a major telehealth solutions company providing accessible, affordable, quality care to individuals through its innovative platform and services. The company develops innovative solutions for individuals, insurers, and healthcare providers to create access to better healthcare solutions.

- Teladoc Health, Inc. has more than 12,000 clients across the globe and provides virtual care, such as mental health, primary care, and chronic condition management.

- Doctor On Demand, Inc. (Included Health), NXGN Management, LLC, and Zoom Video Communications, Inc. are some of the emerging market players in telemedicine market.

- Doctor On Demand, Inc. provides virtual healthcare solutions to patients in remote locations. The solutions provide guidance, advocacy, and access to personalized care through virtual in-person medical assistance for primary care, urgent care, specialty care, chronic disease care, preventive health, and behavioral health.

Recent Developments

- In June 2023, Twilio Inc. declared a partnership with Frame AI to leverage AI for the enhancement of customer engagement. The partnership resulted in the strengthening of AI-powered insights for sharing recommendations, and summarizing health cases.

- In April 2023, Teladoc Health Inc. launched a provider-based care service with the use of telemedicine as a technology for prediabetes and weight management programs.

- In March 2023, American Well Corporation expanded its digital clinical program service for the inclusion of a cardiometabolic program. The purpose is to enable clinicians and health plans to patients remotely through telemedicine.

- In January 2023, Sesame Inc. partnered with Lucira Health for providing telemedicine services to access affordable, convenient, and high quality COVID-19 test and treatment.

- In November 2022, MDLIVE announced its rapid expansion in providing primary virtual care program for enhancing support for patients suffering from chronic illness. The purpose is to provide patients with convenient and seamless access to medical care through telemedicine.

- In September 2022, Doxy.me Inc. extended its telemedicine service reach to 88% of the global population wherein patients can get access to remote health facilities in more than 100 languages.

- In March 2022, Plantronics Inc., renamed as Poly, announced its partnership with Raydiant for making advancements in telemedicine services. The purpose was to optimize remote, hybrid, and in-office team communication for facilitating health communication.

Order a free sample PDF of the Telemedicine Market Intelligence Study, published by Grand View Research.