Heparin Industry Overview

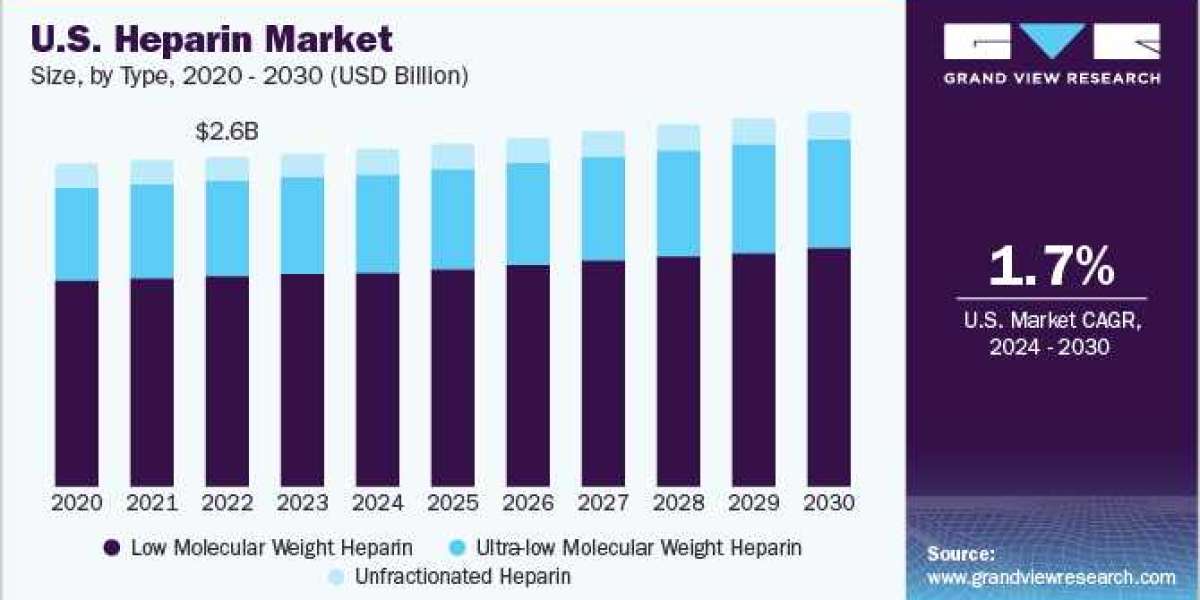

The global heparin market size was estimated at USD 7.56 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 2.7% from 2024 to 2030.

The increasing prevalence of chronic diseases is a major factor in market growth. According to a WHO article published in September 2023, Noncommunicable diseases (NCDs), also known as chronic diseases, cause about 41 million deaths annually, of which 17.9 million deaths are attributed to cardiovascular diseases (CVD). Cancer causes 9.3 million deaths, chronic respiratory diseases lead to 4.1 million deaths, and diabetes contributes to 2 million deaths, including those from diabetes-related kidney diseases. Growing demand for whole blood and blood components transfusion, increasing geriatric population and high usage of plasma in the pharmaceutical industry are factors expected to drive this market’s growth.

Gather more insights about the market drivers, restrains and growth of the Heparin Market

Growing demand for whole blood and blood components transfusion is boosting the demand for the heparin market. Many places worldwide are unable to meet their demand of blood. People are working hard to make more individuals aware of the importance of donating blood. According to an NCBI article published in October 2023, in the U.S. alone, someone needs blood every two seconds, and these transfusions save many lives. As 62 out of 171 countries have a 100% voluntary unpaid blood donation system, it is evident that maintaining an adequate and safe blood supply is challenging. The demand for heparin is set to rise alongside these initiatives, ensuring the success of transfusions and ultimately saving more lives.

The increasing prevalence of health issues in the elderly demographic is likely to propel the demand for heparin, as it plays a crucial role in preventing blood clots during medical procedures necessary for this age group. According to a WHO article published in October 2023, the global demographic over the age of 60 has been increasing, and is expected to double to 2.1 billion by 2050. As the global population ages, there is a higher likelihood of health issues that require medical interventions involving heparin, an anticoagulant crucial for preventing blood clots. This demographic shift poses challenges and opportunities, with the demand for heparin likely to surge as healthcare needs for the elderly become more prominent. The aging population serves as a significant growth driver, highlighting the expanding role of heparin in addressing the unique healthcare demands of an older demographic.

High usage of plasma in the pharmaceutical industry by major players is anticipated to facilitate the market demand. For instance, in March 2023, Takeda's substantial investment of about 100 billion yen (USD 754 million) in building a new manufacturing facility for plasma-derived therapies (PDTs) in Osaka, Japan, signifies a significant market growth driver. This substantial commitment reflects the pharmaceutical industry's increasing reliance on plasma-derived products, including anticoagulants like heparin, highlighting the industry's dedication to meeting the rising demand for essential treatments. Takeda's strategic move aligns with the high usage of plasma in the pharmaceutical sector, emphasizing the crucial role of anticoagulants in addressing patient needs and contributing to the market’s growth.

Browse through Grand View Research's Pharmaceuticals Industry Research Reports.

- The global acne drugs market size was valued at USD 9.22 billion in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030.

- The global cerebral infarction treatment market size was estimated at USD 12.4 billion in 2023 and is projected to grow at a CAGR of 7.3% from 2024 to 2030.

Heparin Market Segmentation

Grand View Research has segmented the global heparin market based on type, route of administration, application, end-use, source, and region:

Heparin Type Outlook (Revenue, USD Million, 2018 - 2030)

- Low Molecular Weight Heparin

- Ultra-low Molecular Weight Heparin

- Unfractionated Heparin

Heparin Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

- Intravenous

- Subcutaneous

Heparin Application Outlook (Revenue, USD Million, 2018 - 2030)

- Venous Thromboembolism

- Atrial Fibrillation

- Renal Impairment

- Coronary Artery Disease

- Others

Heparin End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Outpatient

- Inpatient

Heparin Source Outlook (Revenue, USD Million, 2018 - 2030)

- Porcine

- Bovine

- Others

Heparin Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- China

- Japan

- India

- Australia

- Thailand

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Key Companies profiled:

- Pfizer Inc.

- LEO Pharma A/S

- Reddy’s Laboratories, Ltd.

- GlaxoSmithKline plc

- Sanofi

- Aspen Holdings

- Fresenius SE Co., KGaA

- Braun Medical, Inc.

- Sandoz (Novartis AG)

Key Heparin Company Insights

- Pfizer Inc.; LEO Pharma A/S; and Sanofi are some of the dominant market players.

- Pfizer, Inc. is a pharmaceutical company based in the U.S. and founded in 1849. It manufactures products for curing a wide range of medical disciplines, including diabetes, immunology, cardiology, oncology, dermatological diseases, rare diseases, inflammatory diseases, oncology, and vaccines.

- Sanofi was incorporated in 1994 and is headquartered in France. It engages in RD, manufacturing g, and marketing of therapeutic solutions, comprising diabetes, human vaccines, innovative drugs, consumer healthcare, CVD, internal medicine, immunology, neurology, thrombosis, oncology, arthritis, central nervous system, osteoporosis, primary healthcare, vaccines, animal health, and Genzyme.

- Braun Medical, Inc.; Sandoz (Novartis AG); and Aspen Holdings are some of the emerging market players

- Novartis AG is a Swiss-based multinational company involved in RD, manufacturing, and marketing of healthcare products. The company was formed following the merger of Sandoz Laboratories, Inc. and Ciba-Geigy AG. It is a publicly held organization and operates through two segments: Innovative Medicines and Sandoz.

- Braun Medical, Inc. is involved in developing, manufacturing, and marketing innovative medical products services. The company was established in 1839 and is headquartered in Germany.

Recent Developments

- In June 2023, Techdow USA Inc., part of the Hepalink Group, launched Enoxaparin Sodium (Enoxaparin). This crucial product, available in seven popular pre-filled syringe formats, addresses the critical need for outpatient treatment and prevention of harmful blood clots.

- In July 2023, Endo International's Par Sterile Products business commenced the shipment of bivalirudin injection in a convenient ready-to-use 250 mg/50 mL single-use vial. This product stands out as the sole liquid format of bivalirudin available in the U.S.

- In August 2023, The FDA has approved Delcath Systems, Inc.'s HEPZATO KIT for treating adult patients with metastatic uveal melanoma and unresectable hepatic metastases.

- In November 2023, the FDA has approved CorMedix's antimicrobial drug to reduce catheter-related bloodstream infections in kidney disease patients, marking the company's first commercial product launch.

Order a free sample PDF of the Heparin Market Intelligence Study, published by Grand View Research.