ePharmacy Industry Overview

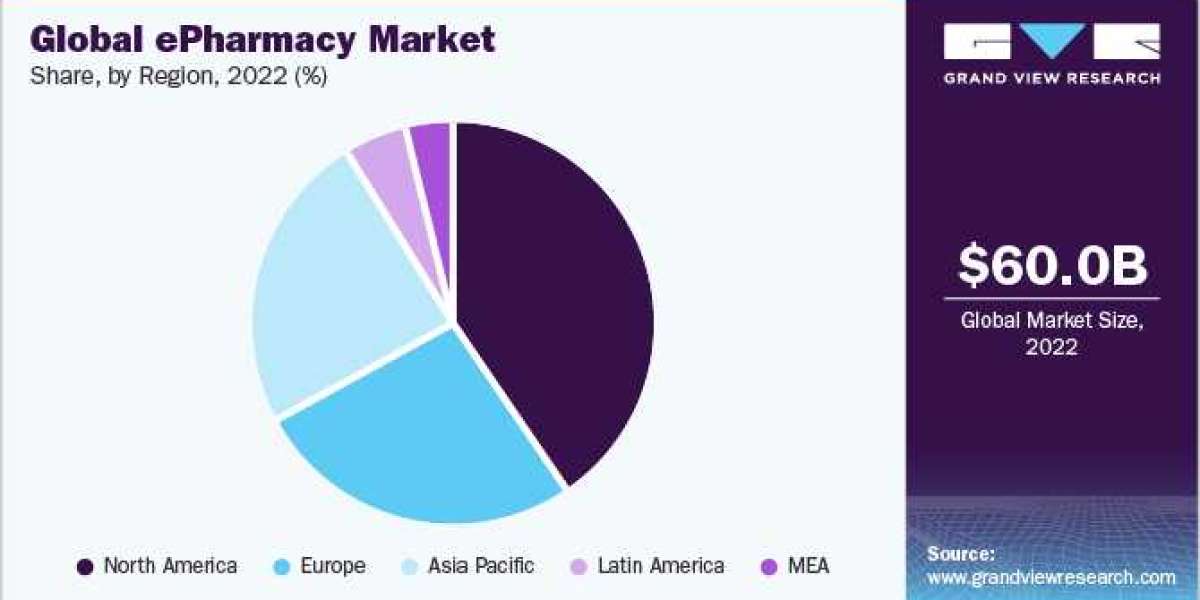

The global ePharmacy market size was valued at USD 60.0 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 20.4% from 2023 to 2030.

Rising penetration of the internet across the globe, improving digitalization of healthcare services, and an increasing number of tech-savvy consumers are the key factors boosting the market growth. Rising consumer preference for online purchases with an increased focus on convenience is also aiding the growth. The increasing adoption of digital technologies and e-commerce in the healthcare sector is anticipated to propel overall growth. In January 2022, Mark Cuban, the venture capitalist, launched a digital pharmacy that sells more than 100 generic pharmaceuticals at a low cost, to be radically transparent. ePharmacy offers easier access that significantly benefits chronic elderly patients from nuclear families, as well as patients that are not in a condition to go out.

Gather more insights about the market drivers, restrains and growth of the ePharmacy Market

Increasing penetration of smartphones is further aiding the market growth. As per The Mobile Economy 2020, smartphone penetration was 65.0% in 2019 and is expected to reach 80.0% by 2025. The boom in the healthcare sector coupled with high operational costs has created the need to cut operational costs with the implementation of ePharmacy solutions. The increasing prevalence of chronic conditions is leading to a rise in the demand for various healthcare products, including drugs. This signifies the increasing penetration of online modes of drug procurement across the globe.

The pandemic has transformed the priorities of health systems worldwide. It has encouraged developing economies to rethink their infrastructure priorities in urban centers. Many countries faced the challenge of tackling the pandemic while making progress on other healthcare goals. Countries including India are rendering the urgency to combat the spread of COVID-19 into opportunities to make more resilient health systems. Increasing government focus on advancement and improvement in the overall healthcare system can contribute to market growth.

Although medical stores were classified as vital services, online pharmacies emerged as one of the largest beneficiaries of the pandemic-induced lockdown, as individuals preferred to buy medicines online to avoid the risk of disease spreading. In March 2022, Walgreens and Labcorp, a prominent global life sciences firm introduced Pixel by Labcorp, its (COVID-19 at-home collection kit), PCR test. Moreover, many communities can obtain easy testing services owing to Walgreens' inclusion of the kits, which are supplied in conjunction with the US Department of Health and Human Services (HHS).

The ePharmacy market increased by 38.0% from 2019 to 2020. High caseloads in countries coupled with regional lockdown had pushed consumers to adopt the ePharmacy platforms to order medicines online from the comfort of their homes, rather than visiting offline pharmacies and diagnostic centers. ePharmacy has gained significant growth during the pandemic owing to a rise in the number of government initiatives supporting the adoption of online purchase of medicines. The COVID-19 pandemic has led to an increase in the strategic initiatives by many market players.

The market will continue to grow post-pandemic, mainly owing to increasing adoption among consumers due to the convenience, affordability, and accessibility offered by these platforms. Increasing digitization and benefits associated with the adoption of ePharmacy over traditional pharmacies are anticipated to drive market growth in the coming years. Moreover, the second wave of the COVID-19 epidemic has prompted a spike in demand for medical gadgets, personal protective equipment (PPE), as well as health supplements, and frequently accessible medications in the ePharmacy market. High caseloads in cities, along with regional lockdowns, have prompted customers to purchase online rather than visit offline pharmacies and diagnostic centers, especially in big metros.

Furthermore, the increasing geriatric population is expected to fuel the growth of the market. Ease of operation, increasing digitalization, and rising number of beneficiaries registering under Medicare are some of the factors supporting the growth. For instance, according to the data published by Kaiser Family Foundation in June 2021, the total enrollment in a Medicare Advantage plan is over 26 million people, accounting for 42.0% of the total Medicare population. In addition, high funding, increasing investments, and rising strategic initiatives being undertaken by several funding agencies, governments, and companies are contributing to the market growth.

However, the presence of some illegitimate online pharmacies is limiting the growth of the market. These unlicensed pharmacies sell medicines that have not been authorized by the FDA, which, in turn, increases the possibility of obtaining counterfeit and adulterated medications with incorrect active ingredients from these pharmacies. For instance, as per a warning issued by the FDA in 2020, some online pharmacies were caught to be engaged in illegal activity and violating the U.S. Federal Food, Drug, and Cosmetic Act, which included some points, such as the sale of unapproved prescription drugs, sale of prescription drugs without prescription, inadequate explanation of directions for safe use of some prescription drugs, etc. In addition, in June 2021, the FDA also published a list of illegally operating online pharmacies (not all-inclusive), such as Buy Pharma, Rx 2 Go Pharmacy, Pharmacy Geoff’ and Sandra Pharma, that have been issued warning letters.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

- The global point of care connectivity solutions market was estimated at USD 1.02 billion in 2023 and is projected to grow at a CAGR of 7.40% from 2024 to 2030.

- The global lung cancer screening software market size was valued at USD 24.6 million in 2023 and is projected to grow at a CAGR of 6.9% from 2024 to 2030.

ePharmacy Market Segmentation

Grand View Research has segmented the global ePharmacy market based on drug type, and region:

ePharmacy Drug type Outlook (Revenue, USD Million, 2017 - 2030)

- Prescription drug

- Over-the-counter drug (OTC)

ePharmacy Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- Italy

- Spain

- France

- Russia

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- Singapore

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Key Companies profiled:

- The Kroger Co.

- Walgreen Co.

- Giant Eagle, Inc.

- Walmart, Inc.

- Express Scripts Holding Company

- CVS Health

- Optum Rx, Inc.

- Rowlands Pharmacy

- DocMorris (Zur Rose Group AG)

- Cigna Corporation (Express Scripts Holdings)

- com Inc.

- Axelia Solutions (Pharmeasy)

- Apex Healthcare Berhad (Apex Pharmacy)

- Apollo Pharmacy

- Netmeds

Order a free sample PDF of the ePharmacy Market Intelligence Study, published by Grand View Research.