Automated Test Equipment Industry Overview

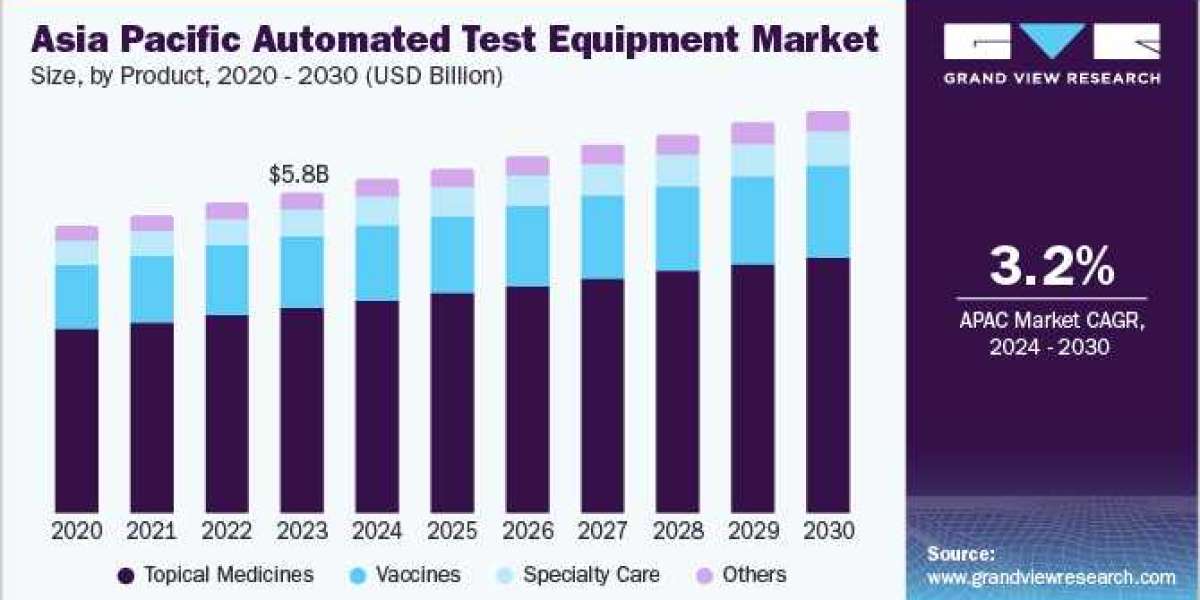

The global automated test equipment market size was valued at USD 7,643.8 million in 2023 and is expected to register a compound annual growth rate (CAGR) of 3.1% from 2024 to 2030.

The growth is driven by the use of Automated Test Equipment (ATE) in the automotive and semiconductor industry. A significant increase in the number of connected devices and consumer electronics, along with an increasing focus of many companies on quality improvement along with end-to-end testing solutions, is expected to further drive the market. Implementation of ATE in semiconductor manufacturing companies to enhance performance capability and speed of operation and, in turn, reduce the cost of semiconductor devices is expected to positively influence growth.

Gather more insights about the market drivers, restrains and growth of the Automated Test Equipment Market

Increasing adoption of System on Chip (SoC) and high demand for consumer electronics is expected to be a key driving force for the ATE market over the forecast period. Growing electronic components in the automotive sector and penetration of smartphones are expected to drive the market. Miniaturization has widened the scope of ATE application. Additionally, considerable technological advancements coupled with design complexity and the need for effective testing are expected to fuel the market.

Advancements in semiconductor manufacturing processes, along with the expansion of wireless networks in developing nations, are expected to significantly drive the automatic test equipment market growth in the forthcoming years. Additionally, considerable technological advancements coupled with design complexity and the need for effective testing are a few factors expected to benefit the market expansion.

Recent technological advancements have significantly reduced the cost and time for manufacturing semiconductor ICs and have increased the profit margin for the companies. Automated test equipment manufacturers constantly invest in RD activities to enhance their product portfolio and to fit in with the latest improvements in semiconductor devices.

Browse through Grand View Research's Electronic Devices Industry Research Reports.

- The global consumer electronics market size was valued at USD 1,068.22 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030.

- The global autonomous vehicle market size was valued at USD 42.37 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 21.9% from 2023 to 2030.

Automated Test Equipment Market Segmentation

Grand View Research has segmented the global automated test equipment market report based on product, type, vertical, and region:

Automated Test Equipment Product Outlook (Revenue, USD Million; 2017 - 2030)

- Non-Memory ATE

- Memory ATE

- Discrete

- Others

Automated Test Equipment Type Outlook (Revenue, USD Million; 2017 - 2030)

- Logic Testing

- Linear or mixed Signal Equipment

- Passive Component ATE

- Discrete ATE

- Printed Circuit Board (PCB) Testing

- Interconnection and Verification Testing

Automated Test Equipment Vertical Outlook (Revenue, USD Million; 2017 - 2030)

- Automotive

- Consumer Electronics

- Aerospace Defense

- IT Telecommunication

- Healthcare

- Others

Automated Test Equipment Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- Japan

- South Korea

- Taiwan

- Singapore

- India

- Malaysia

- Australia

- South America

- Brazil

- Middle East and Africa (MEA)

- KSA

- UAE

- South Africa

Key Companies profiled:

- Aemulus Corporation

- Chroma ATE Inc.

- VIAVI Solutions Inc.

- Astronics Corporation

- ADVANTEST CORPORATION

- Cohu, Inc

- Teradyne Inc.

- STAr Technologies Inc.

- TESEC Corporation

- Roos Instruments

- Marvin Test Solutions, Inc.

- Danaher

Key Automated Test Equipment Company Insights

Some of the key players operating in the market include Astronics Corporation, ADVANTEST CORPORATION, Chroma ATE Inc., and Teradyne Inc.

- Astronics Corporation is a U.S.-based company offering advanced technology solutions to electronics, aerospace defense industries. The company offers numerous products and services, including avionics products and automated test systems. It operates in two segments, namely Aerospace and Test Systems. The company has principal operations in the U.S., France, Canada, and U.K.

- Chroma ATE Inc. is a Taiwan-based company that offers intelligent manufacturing systems, precision test and measurement instrumentation, and automated test systems. The company serves various markets, including power electronics, semiconductors, electric vehicles, and passive components. It has a global presence with offices in the U.S., Europe, Japan, South Korea, Southeast Asia, and China.

- TESEC Corporation and Roos Instruments are some of the emerging automated test equipment manufacturers.

- TESEC Corporation is a Japan-based manufacturer of semiconductor equipment. The company offers automated handlers and test systems for the semiconductor industry. Along with handlers and test systems, the company also offers after-sale support services. It has a global presence with companies in the U.S., Malaysia, and China.

- Roos Instruments is a U.S.-based company that offers manufactures automated test equipment and develops software for the semiconductor industry. The company offers application-based solutions to automated test equipment and designs test instrument modules. It develops end-to-end solutions, test infrastructure, and expert system software.

Recent Developments

- In January 2023, Roos Instruments announced the launch of the RI8607 50 GHz Test Set. The new instrument enhances the capabilities of Cassini's vector measurement system. The instruments can be used for various applications, including automotive radar and cellular backhaul.

- In October 2022, Chroma ATE Inc. launched the next generation Chroma 3650-S2 high performance power IC test platform. It is an automated testing equipment designed for testing battery, power management ICs (PMICs), and power conversion.

Order a free sample PDF of the Automated Test Equipment Market Intelligence Study, published by Grand View Research.