Hydrogen Energy Storage Industry Overview

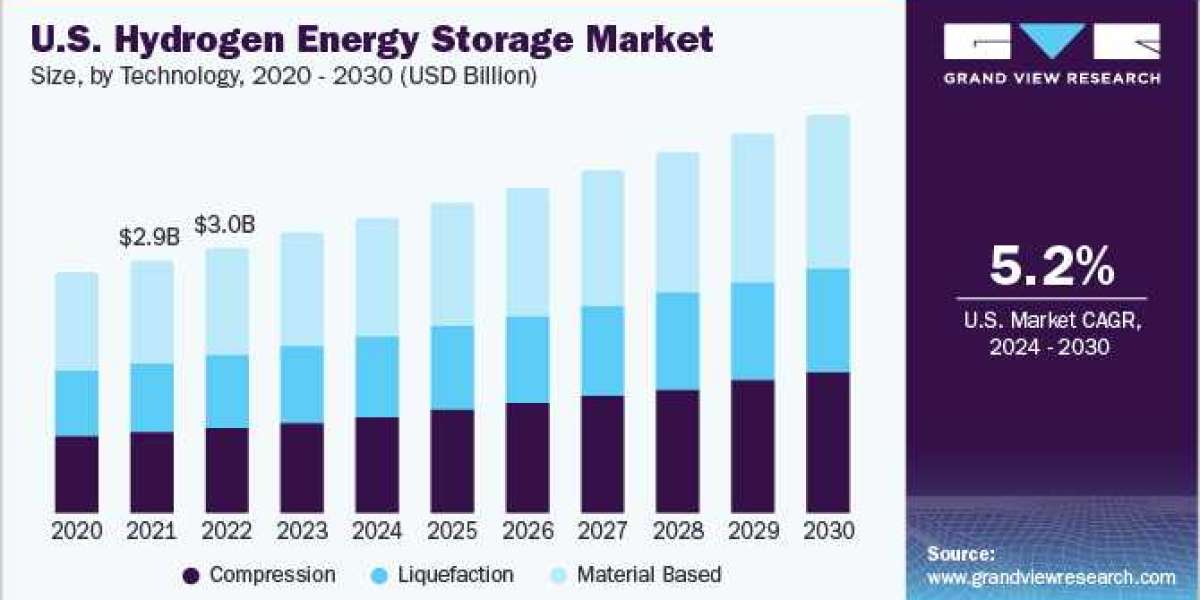

The global hydrogen energy storage market size was estimated at USD 15.97 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030. The growth can be primarily attributed to the swift industrialization of developing countries and increasing acceptance of alternative forms of energy. The U.S. market is projected to witness significant growth over the forecast period owing to ongoing research development and construction of full-scale storage projects. The Hydrogen Fueling Infrastructure Research and Station Technology (H2FIRST) is a part of the initiative undertaken by the Fuel Cell Technologies Office, based on prevalent and upcoming technologies at national labs.

Gather more insights about the market drivers, restrains and growth of the Hydrogen Energy Storage Market

The development and construction of cost-effective and energy-saving hydrogen stations across the U.S. are among the key objectives planned by the government. Such factors are expected to boost market growth in the U.S. Increased hydrogen applications across a variety of industries are predicted to fuel market expansion. Hydrogen, for example, can be used for industrial applications in oil refineries, power generation in stationary fuel cells, as a fuel in fuel cell vehicles, and stored as a cryogenic liquid, compressed gas, or loosely bonded hydride chemical compound.

According to the International Renewable Energy Agency (IRENA), for renewable hydrogen to be competitive with fossil fuel-produced hydrogen, it should be generated at less than USD 2.5 per kg. Cost is determined by a number of factors, including the location of production, market segment, renewable energy power tariffs, future electrolyzer investments, and others. Because of the low cost of hydrogen manufacturing, more energy storage systems will be deployed. Industry participants are substantially forward-integrated. The demand for stored hydrogen in a variety of applications, including fuel cell automobiles, grid services, and telecommunications, is forcing market players to integrate their facilities with end-use industries.

Browse through Grand View Research's Renewable Energy Industry Research Reports.

- The global fuel cell vehicle market size was valued at USD 1.45 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 52.5% from 2023 to 2030.

- The global green hydrogen market size was valued at USD 3.2 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 39.5% from 2022 to 2030.

Hydrogen Energy Storage Market Segmentation

Grand View Research has segmented the global hydrogen energy storage market on the basis of on technology, physical state, application, and region:

Hydrogen Energy Storage Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Compression

- Liquefaction

- Material Based

Hydrogen Energy Storage Physical State Outlook (Revenue, USD Million, 2018 - 2030)

- Solid

- Liquid

- Gas

Hydrogen Energy Storage Application Outlook (Revenue, USD Million, 2018 - 2030)

- Residential

- Commercial

- Industrial

Hydrogen Energy Storage Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- Russia

- UK

- Spain

- Italy

- France

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Central South America

- Brazil

- Colombia

- Paraguay

- Middle East Africa

- Saudi Arabia

- UAE

- South Africa

- Egypt

Key Companies profiled:

- Air Liquide

- Air Products Inc.

- Cummins Inc.

- Engie

- ITM Power

- Iwatani Corporation

- Linde plc

- Nedstack Fuel Cell Technology BV

- Nel ASA

- Steelhead Composites Inc.

Key Hydrogen Energy Storage Company Insights

Enhanced level of forward integration, strong research and development, security of renewable energy power supply, and cost of storage are among the significant factors driving the competitiveness of the hydrogen energy storage industry. In September 2023, India is expected to launch 100 MW of green hydrogen storage pilot project for round-the-clock power supply.

Order a free sample PDF of the Hydrogen Energy Storage Market Intelligence Study, published by Grand View Research.