Newborn Screening Industry Overview

The global newborn screening market size was valued at USD 789.35 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.54% from 2023 to 2030.The rising neonatal population, increasing cases of congenital diseases in newborns, growing consumer awareness, and favorable initiatives support from various governments organizing several programs legislations are factors estimated to propel market growth over the forecast period. In addition, technological advancements in screening methodologies are also expected to boost the market.

Gather more insights about the market drivers, restrains and growth of the Newborn Screening Market

The extensively growing prevalence of congenital diseases in newborns is expected to have a positive impact on the market growth for newborn screening. According to data published by the WHO in February 2023, an estimated 240,000 newborns die within 28 days of birth each year globally due to congenital diseases. Congenital disorders are further responsible for an estimated 170,000 child deaths aged between 1 month and 5 years. In addition, according to information from Indian Pediatrics, congenital hypothyroidism occurs in 2.1 out of every 1,000 infants in India, and the prevalence of inborn metabolic abnormalities ranges from 2-7.8%. Such substantial occurrence of congenital diseases amongst newborns is likely to increase the adoption of tests, which will eventually accelerate market growth by 2030.

In addition, the introduction of government programs and legislation is also expected to offer a favorable environment for the newborn screening industry growth. For instance, in June 2022, the government of Manitoba announced the expansion of its newborn screening program with an aim to extend screening for spinal muscular atrophy along with other diseases. A majority of the nations have statutes for newborn screening, wherein funding for the program, various conditions requiring screening, and exemptions are clearly stated. For instance, the Manitoba government increased its budget by USD 4.2 million to deal with the additional workload of diagnosis.

The demand for newborn screening procedures is expected to be influenced by the introduction of new technologies and availability of treatment options enabling the diagnosis of about 29 possible disorders, including galactosemia (GS), phenylketonuria (PKU), hearing disorders, and congenital hypothyroidism (CH) in neonates. In March 2023, a group of scientists at the Division of Laboratory Sciences, CDC, announced the introduction of improved tests that offer advanced technology for the diagnosis of genetic diseases.

Browse through Grand View Research's Clinical Diagnostics Industry Research Reports.

- The global point of care infectious disease testing market size was valued at USD 11.40 billion in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030.

- The global transplant diagnostics market size was valued at USD 5.97 billion in 2023 and is projected to grow at a CAGR of 7.3% from 2024 to 2030.

Newborn Screening Market Segmentation

Grand View Research has segmented the global newborn screening market on the basis of product, technology, test type, and region:

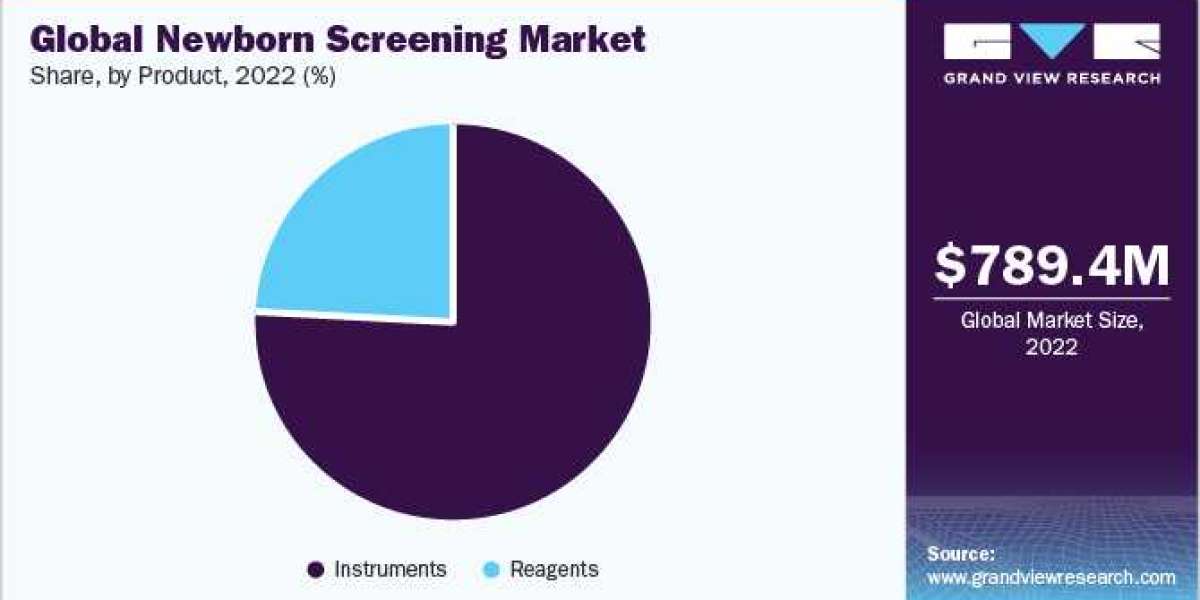

Newborn Screening Product Outlook (Revenue, USD Million, 2018 - 2030)

- Instruments

- Reagents

Newborn Screening Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Tandem Mass Spectrometry

- Pulse Oximetry

- Enzyme Based Assay

- DNA Assay

- Electrophoresis

- Others

Newborn Screening Test Type Outlook (Revenue, USD Million, 2018 - 2030)

- Dry Blood Spot Test

- CCHD

- Hearing Screen

Newborn Screening Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- Thailand

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Key Companies profiled:

- Bio-Rad Laboratories

- Agilent Technologies

- Covidien plc

- Masimo

- Waters Corporation

- Natus Medical

- Trivitron Healthcare

- GE Lifesciences

- PerkinElmer Inc

- AB SCIEX

Key Newborn Screening Company Insights

The industry players are actively involved in strategic partnerships and mergers acquisitions in order to ensure sustainability. For example, Trivitron Healthcare and Agilent Technologies have partnered to initiate collaboration in the area of high-precision in-vitro diagnostics based on the LC-MS/MS platform. Furthermore, in January 2023, Masimo announced the launch of its new state-of-the-art baby monitoring system.

Order a free sample PDF of the Newborn Screening Market Intelligence Study, published by Grand View Research.