Supply Chain Security Industry Overview

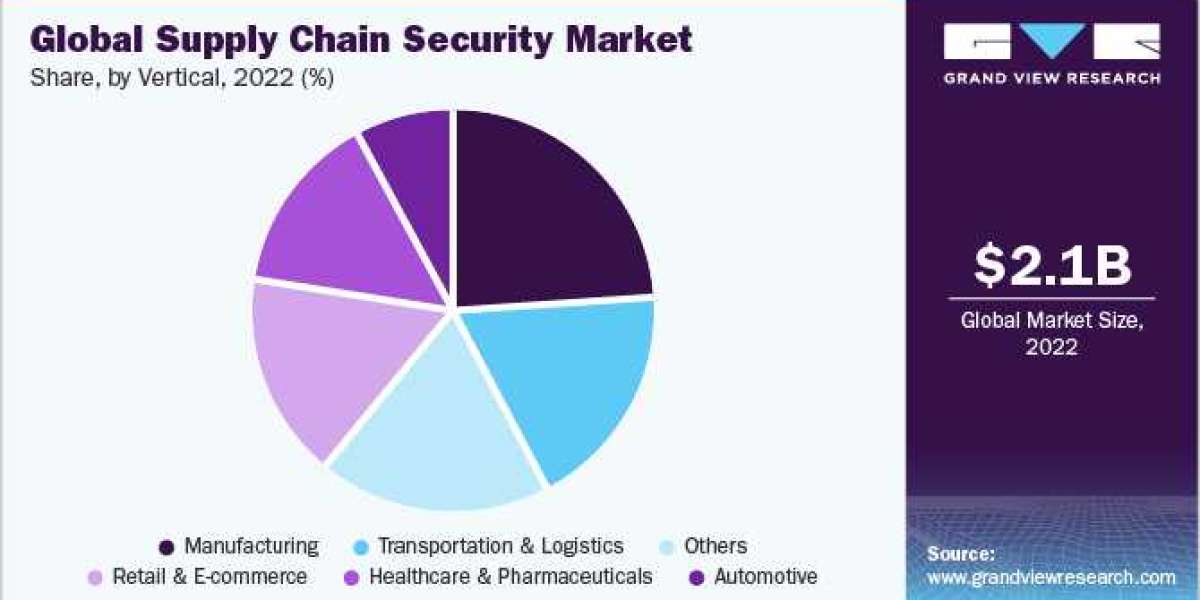

The global supply chain security market size was evaluated at USD 2.13 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 11.1% from 2023 to 2030.

The growing number of cyberattack incidents across supply chain process is expected to drive the demand for supply chain security. Supply chain security solution enables customers to focus on managing external vendors, transportation, suppliers, and logistics risks. The increasing need for transparency and sustainability is further boosting market growth. However, high cost associated with deploying security solutions can hamper market growth, majorly across Small- And Medium-Sized Enterprises (SMEs). Supply chain cyberattacks refer to the vulnerabilities in software systems, such as piracy, malware attacks, unauthorized access across software, and malicious backdoor attacks.

Gather more insights about the market drivers, restrains and growth of the Supply Chain Security Market

The increasing adoption of advanced solutions and growing focus of businesses on digitization initiatives are leading to the generation of a vast amount of data in industrial sector. Industry 4.0 is gaining traction and companies across several industries are incorporating latest solutions and technologies that provide real-time insights across their operations. Moreover, the increasing need to reduce complexity in supply chain, save operational costs, increase productivity, and ensure fast and safe delivery of goods is compelling companies to deploy supply chain security solutions. The rising implementation of advanced technologies across industries is leading to the accumulation of vast volumes of rich business data that can offer a wide range of insights.

Companies’ focus on data-driven decision-making has also encouraged the use of Big Data and data analytics in the supply chain management process. Governments of several countries have announced multiple projects aimed at improving supply chain management through implementation of latest technologies. Due to the increasing adoption of such technologies, demand for supply chain analytics has spiked in recent years. At the same time, cyberattacks are getting more sophisticated, and losses stemming from cyberattacks are also increasing. While new networks are being rolled out and existing networks are being expanded, these networks are increasingly becoming vulnerable to cyber threats. These factors are contributing to the growth of supply chain security market.

Browse through Grand View Research's Network Security Industry Research Reports.

- The big data security market size was estimated at USD 20.82 billion in 2023 and is anticipated to grow at a CAGR of 17.3% from 2024 to 2030.

- The virtualization security market size was estimated at USD 2.23 billion in 2023 and is anticipated to expand at a CAGR of 15.4% from 2024 to 2030.

Supply Chain Security Market Segmentation

Grand View Research has segmented the global supply chain security market based on component, security type, enterprise size, vertical, and region:

Supply Chain Security Component Outlook (Revenue, USD Billion, 2018 - 2030)

- Hardware

- Software

- Services

Supply Chain Security Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Data Locality Protection

- Data Visibility Governance

- Others

Supply Chain Security Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

- Small Medium-sized Enterprises

- Large Enterprises

Supply Chain Security Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

- Healthcare Pharmaceuticals

- Retail E-commerce

- Automotive

- Transportation Logistics

- Manufacturing

- Others

Supply Chain Security Regional Outlook (Revenue, USD Billion, 2018 - 2030)

North America

- S.

- Canada

Europe

- Germany

- UK

- France

- Italy

- Spain

Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

Latin America

- Brazil

- Mexico

- Argentina

Middle East Africa

- A.E

- Saudi Arabia

- South Africa

Key Companies profiled:

- Altana

- Dickson, Inc.

- ELPRO-BUCHS AG

- Emerson Electric Co.

- International Business Machines Corporation

- Hanwell Solutions

- Monnit Corporation

- NXP Semiconductors N.V.

- Oracle Corporation

- ORBCOMM

- Rotronic Instrument Corp.

- SafeTraces

- Sensitech Inc.

- Tagbox Solutions

- Testo SE Co. KGaA

Key Supply Chain Security Company Insights

Industry players utilize a variety of inorganic growth tactics, such as partnerships, regular mergers, and acquisitions, to broaden their product offering. In February 2022, Oracle Corporation launched new logistic capabilities within Oracle Fusion SCM.

Recent Developments

- In June 2023, Emerson Electric Co. launched its new ASCO Series 641, 642, and 643 Aluminum Filter Regulators. These new products are designed to reduce unplanned downtime and maximize process efficiency in a wide range of process applications.

- In May 2023, NXP Semiconductors N.V. introduced a new i.MX 91 application processor series to deliver a powerful blend of features, security capability, and energy-efficient performance across the next generation Linux-enabled IoT and industrial applications.

- In February 2023, ELPRO-BUCHS AG announced the shifting of its sales and service office to a large premise in Singapore. This initiative is expected to support the company’s growth strategy in Asia Pacific.

Order a free sample PDF of the Supply Chain Security Market Intelligence Study, published by Grand View Research.