Automotive Glass Industry Overview

The global automotive glass market size was valued at USD 30.8 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030.

An increasing emphasis on lightweight cars on account of rising harmful emissions from vehicles that have an adverse effect on the environment is driving glass penetration in the automotive industry. According to the International Organization of Motor Vehicle Manufacturers (OICA), the production of automobiles reached 85.02 million vehicles globally in 2022. The strong production volume is attributed to the development of the automotive manufacturing sector, particularly in countries such as China and India, owing to increasing government initiatives regarding motor vehicle regulations.

Technological advancements in the automotive sector, along with continuous upgradation in vehicle designs, have compelled market players to introduce advanced products for automotive manufacturers. For instance, in FY 2018-2019, AIS Glass in India offered its products to various new car models with several innovative changes, including solar green glass and acoustic PVB, for the Toyota Yaris and a 2.8mm backlite for the new Wagon R.

Gather more insights about the market drivers, restrains and growth of the Automotive Glass Market

The rise in the production of electric vehicles and the incorporation of various new technologies in terms of display and battery are expected to have a positive influence on the demand for automotive glass over the forecast period. For instance, in June 2019, Lightyear, a Dutch company, introduced the first prototype of its electric car called the Lightyear One, which has five square meters of integrated solar cells beneath the roof and hood. These solar panels are produced from safety glass and can recharge directly from the sun.

The major challenge for the market is concerning the raw materials required to produce glass. Raw materials and energy utilization account for a major share in the cost structure of glass and their supply has a direct impact on glass production and its prices. For instance, the price of a key raw material, soda ash, has witnessed a constant increase over the past few months, one of the reasons being its limited supply. In order to remedy this situation, soda ash manufacturers are increasing their production capacities to fulfill the demand from key markets such as automotive glass, chemicals, and industrial products.

Growing emphasis on fuel efficiency and reduction in harmful emissions from vehicles has led to increased production of lightweight and electric vehicles. This is anticipated to boost the demand for glass in the automotive industry in the coming years. The automotive industry has been witnessing significant technological innovations over the past many years.

Despite the decline in the overall production of vehicles, the demand for automotive glass is anticipated to remain steady over the forecast period due to the increasing production of commercial vehicles and electric cars. The rising production of commercial vehicles is a positive sign for the global market for automotive glass. In addition, a significant rise in the production of EVs is further anticipated to provide lucrative opportunities for the growth of the automotive glass industry.

Along with advancements in vehicles, such as the transition from fuel-based to electric and from manual to automatic, technological developments are also being witnessed in the case of glass, such as the dimmable and display glass technology by Gentex Corporation. The company introduced a full-display mirror, which turns the rearview mirror into a screen. This can be seen in the Chevy Bolt EV.

Browse through Grand View Research's Specialty Glass, Ceramic Fiber Industry Research Reports.

- The global bioceramics market size was valued at USD 7.67 billion in 2023 and is expected to grow at a CAGR of 7.0% from 2024 to 2030.

- The global para-aramid fibers market size was estimated at USD 3.21 billion in 2023 and is anticipated to grow at a CAGR of 7.9% from 2024 to 2030.

Automotive Glass Market Segmentation

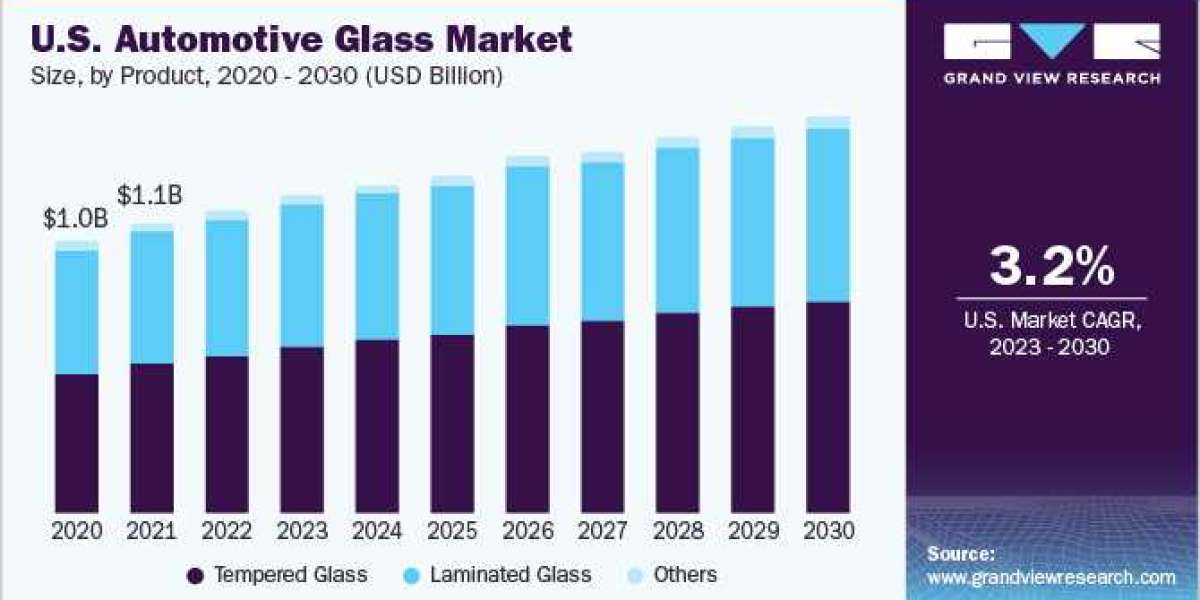

Grand View Research has segmented the global automotive glass market based on product, vehicle type, application, end-use, and region:

Automotive Glass Product Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Tempered Glass

- Laminated Glass

- Others

Automotive Glass Vehicle Type Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Automotive Glass Application Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Windscreen

- Backlite

- Sidelite

- Others

Automotive Glass End-use Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- Original Equipment Manufacturer (OEM)

- Aftermarket

Automotive Glass Regional Outlook (Revenue, USD Million; Volume, Thousand Square Meters, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Turkey

- Asia Pacific

- China

- Japan

- India

- Australia

- Thailand

- South Korea

- Indonesia

- Malaysia

- Latin America

- Brazil

- Argentina

- Middle East and Africa

- South Africa

- Morocco

Key Companies profiled:

- AGC Inc.

- Fuyao Glass Industry Group Co., Ltd.

- Nippon Sheet Glass Co., Ltd.

- Saint-Gobain

- Xinyi Glass Holdings Limited

- Vitro

- Central Glass Co., Ltd.

- Corning Incorporated

- Guardian Industries

- TAIWAN GLASS IND. CORP.

Order a free sample PDF of the Automotive Glass Market Intelligence Study, published by Grand View Research.