Post-Consumer Recycled Plastics Industry Overview

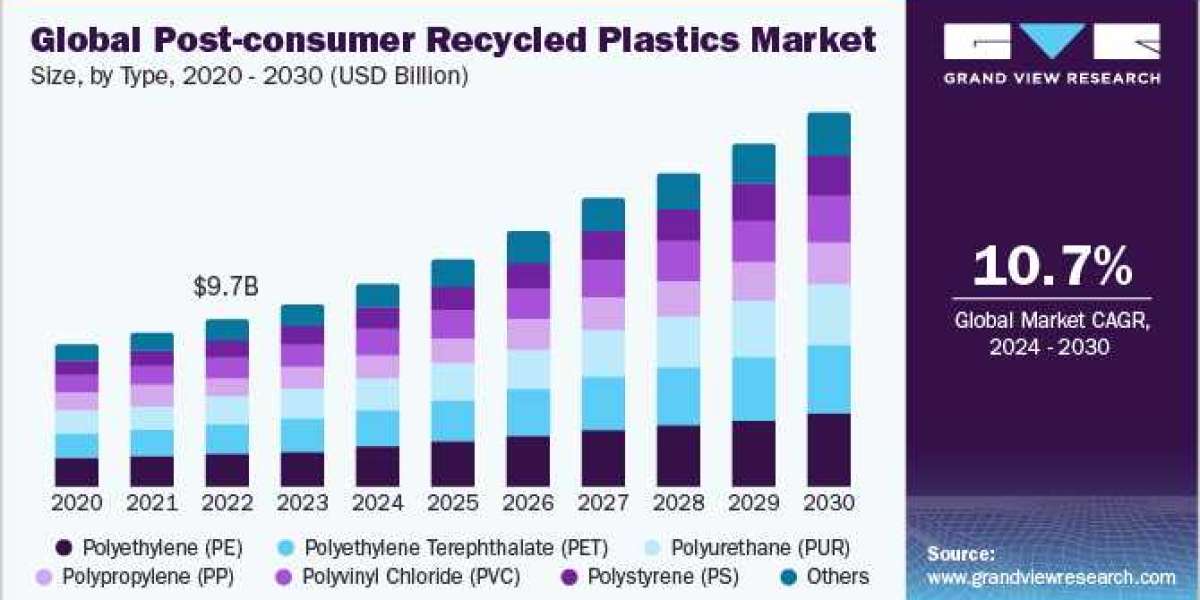

The global post-consumer recycled plastics market size was estimated at USD 10.66 billion in 2023 and is expected to grow at a CAGR of 10.7% from 2024 to 2030.

The market growth can be attributed to the rising sustainability measures undertaken by food beverage and packaging companies to use recycled plastic materials. Growing efforts for a circular economy by end-users and increasing adoption of recycled plastics in the packaging, textiles, and other end-use industries are anticipated to drive the global demand for post-consumer recycled (PCR) plastics.Technological advancements in recycling to produce highly effective and advanced post-recycled plastics have been one of the major market drivers.

Gather more insights about the market drivers, restrains and growth of the Post-Consumer Recycled Plastics Market

For instance, in October 2023, Repsol S.A. and Signode Industrial Group LLC launched a ready-to-use strap produced from a polypropylene (PP) composition containing 30% recycled content for utilization in high-tenacity applications. Moreover, the growth of the global market can be attributed to the high demand for PCR plastics from various end-use industries, including building construction, packaging, electrical electronics, textiles, and automotive as an alternative to traditional virgin fossil-based plastics. Construction activities are witnessing growth in China, India, the U.S., and Saudi Arabia owing to various redevelopment projects.

These projects involve residential and commercial development, the establishment of affordable housing units, and government spending on healthcare facilities, which is expected to drive product demand in the building construction industry. One of the major challenges faced by the market includes waste management and advanced plastic recycling technologies. Due to the environmental risks and economic benefits, the global plastic waste trade flows from high-income countries to low-income countries.

Browse through Grand View Research's Plastics, Polymers Resins Industry Research Reports.

- The global wood pallets market sizewas estimated to be USD 13.12 billion in 2023, growing at a CAGR of 4.5% from 2024 to 2030.

- The global food wrap market size was estimated at USD 5.15 billion in 2023 and is projected to grow at a CAGR of 7.5% from 2024 to 2030.

Post-consumer Recycled Plastics Market Segmentation

Grand View Research has segmented the global post-consumer recycled plastics market based on source, type, and region:

Post-consumer Recycled Plastics Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Bottles

- Non-bottle Rigid

- Others

Post-consumer Recycled Plastics Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Polypropylene (PP)

- Polystyrene (PS)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyurethane (PUR)

- Polyethylene Terephthalate (PET)

- Others

Post-consumer Recycled Plastics Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Central South America

- Brazil

- Middle East Africa

- Saudi Arabia

Key Companies profiled:

- BASF SE

- SABIC

- Evonik Industries AG

- Sumitomo Chemical Co., Ltd.

- Arkema

- Celanese Corporation

- Eastman Chemical Company

- Chevron Phillips Chemical Company

- Exxon Mobil Corporation

- Covestro AG

Key Post-consumer Recycled Plastics Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers acquisitions, and joint ventures, to maintain and expand their market share.

- In November 2023, LyondellBasell Industries Holdings B.V. announced the establishment of an industrial-scale catalytic advanced plastic recycling demonstration plant at the Wesseling location of the company in the country. It will be the first single-train recycling plant of LyondellBasell Industries Holdings B.V. that is expected to convert post-consumer plastic waste into feedstocks for fresh plastic production

- In August 2023, Borouge, a joint venture between Borealis and the Abu Dhabi National Oil Company (ADNOC) in the UAE, announced the debut of new polypropylene (PP) products for the automobile sector that contains up to 70% PCR materials. The first solution comprises 50% PCR material, lowering the carbon footprint by approximately 28% compared to virgin grades. The second solution, which incorporates up to 70% PCR materials, was designed to produce wheel arches and other exterior components.

- In January 2023, PureCycle, an advanced recycling company, and the Port of Antwerp-Bruges jointly announced plans to develop PureCycle's first polypropylene (PP) recycling facility in Europe. The new factory is projected to have an annual capacity of 59,000 metric tons (130 million pounds), with a high growth potential. The 14-hectare (35-acre) site can accommodate up to four processing lines, with an estimated total capacity of 240,000 metric tons (500 million pounds) per year.

Order a free sample PDF of the Post-consumer Recycled Plastics Market Intelligence Study, published by Grand View Research.