Inflammatory Bowel Disease Treatment Industry Overview

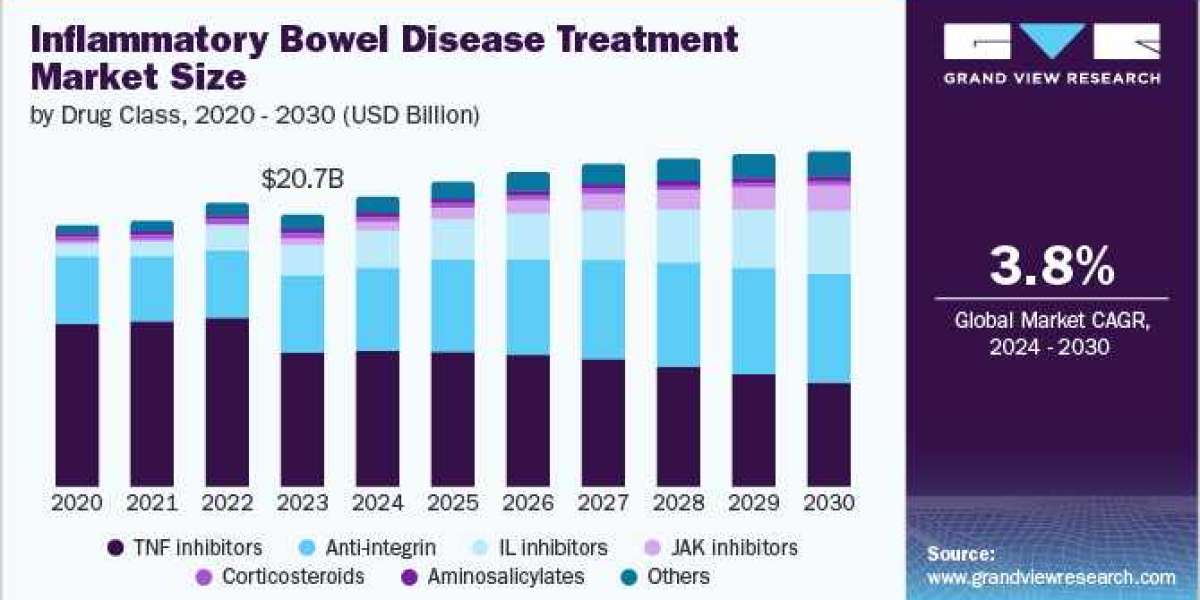

The global inflammatory bowel disease treatment market size was estimated at USD 20.74 billion in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2030.

The rising prevalence of ulcerative colitis and Crohn's disease across the globe and increasing approval of novel therapeutics are anticipated to drive the market during the forecast period. Moreover, an increase in the adoption of biological drugs and a surge in government initiatives to improve healthcare services for patients with inflammatory bowel disease (IBD), as these patients are more susceptible to acquiring infections owing to immunosuppressive therapies, further support the market expansion.

Gather more insights about the market drivers, restrains and growth of the Inflammatory Bowel Disease Treatment Market

The rising prevalence of ulcerative colitis and Crohn's disease is anticipated to fuel the growth of the inflammatory bowel disease treatment market. According to EFCCA, around 10 million people are living with inflammatory bowel diseases worldwide, and the incidence of the disease is expected to increase over the forecast period. Similarly, a study published by the Crohn's Colitis Foundation in July 2023 estimated that 721 per 100,000 Americans were diagnosed with inflammatory bowel disease. Moreover, in September 2023, NCBI published that more than 320,000 people in Canada will have IBD in 2023, and it is expected to reach 470,000 IBD patients by 2035 in the country.

The upcoming product launches and a strong product pipeline will drive market growth. For instance, in April 2023, AbbVie Inc. received the European Commission (EC) approval for Rinvoq (upadacitinib) to treat moderate to severe Crohn's disease in adult patients. Current therapies focus on reducing inflammation, risks of complications, and long-term remission. Moreover, hospitals healthcare institutes are working closely with pharmaceutical companies to conduct clinical trials and ensure the safety of patients. Such initiatives are expected to increase research activities and develop a novel treatment for IBD.

The leading participants in the IBD treatment market emphasize adopting advanced technologies like AI for drug discovery and offering new treatments for Crohn's disease and ulcerative colitis. For instance, in December 2023, Insilico Medicine dosed the first patients with its ISM5411, an investigational IBD drug candidate designed using generative artificial intelligence. Moreover, leading companies and tech innovators are collaborating to leverage each other's technologies and competencies to innovate novel regimens and strengthen their position. For instance, in May 2021, CytoReason, an Israel-based tech company, announced a partnership with Ferring Pharmaceuticals to accelerate the drug development process and innovate novel therapeutics for IBD using AI technology.

Browse through Grand View Research's Pharmaceuticals Industry Research Reports.

- The global insomnia therapeutics market size was valued at USD 2.79 billion in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030.

- The global ankylosing spondylitis market sizewas valued at USD 5.78 billion in 2023 and is projected to grow at a CAGR of 6.4% from 2024 to 2030.

Inflammatory Bowel Disease Market Segmentation

Grand View Research has segmented the global inflammatory bowel disease treatment market based on type, drug class,route of administration, distribution channel, and region:

Inflammatory Bowel Disease Treatment Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Crohn's Disease

- Ulcerative Colitis

Inflammatory Bowel Disease Treatment Drug Class Outlook (Revenue, USD Billion, 2018 - 2030)

- Aminosalicylates

- Corticosteroids

- TNF inhibitors

- IL inhibitors

- Anti-integrin

- JAK inhibitors

- Others

Inflammatory Bowel Disease Treatment Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

- Oral

- Injectable

Inflammatory Bowel Disease Treatment Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Inflammatory Bowel Disease Treatment Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- S.

- Canada

- Europe

- Germany

- UK

- Spain

- France

- Italy

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Singapore

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Key Companies profiled:

- AbbVie Inc.

- Takeda Pharmaceutical Company Limited

- Pfizer Inc.

- Biogen

- Novartis AG

- Lilly

- UCB S.A.

- CELLTRION INC.

- Merck Co., Inc.

- Johnson Johnson Services, Inc

Recent Developments

- In May 2024, Johnson and Johnson Services Inc., announced the first phase 3 results for Tremfya’s Crohn’s disease program. The data from phase 3 trial demonstrated that Tremfya is superior to Stelara in all the endoscopic patients in the trial pool.

- In April 2024, Takeda Pharmaceutical Company Limited received FDA approval for subcutaneous administration of Entyvio post-induction therapy with IV Entyvio. The drugs are used to treat patients with severely active Crohn’s Disease.

- In October 2023, Johnson Johnson Services, Inc. announced the data from a phase 3 clinical trial of Tremfya (guselkumab), studying the safety and efficacy of the drug for active ulcerative colitis. The study showed a 77% overall clinical response rate and early symptom improvement in UC patients.

Order a free sample PDF of the Inflammatory Bowel Disease Treatment Market Intelligence Study, published by Grand View Research.