Air Quality Monitoring System Industry Overview

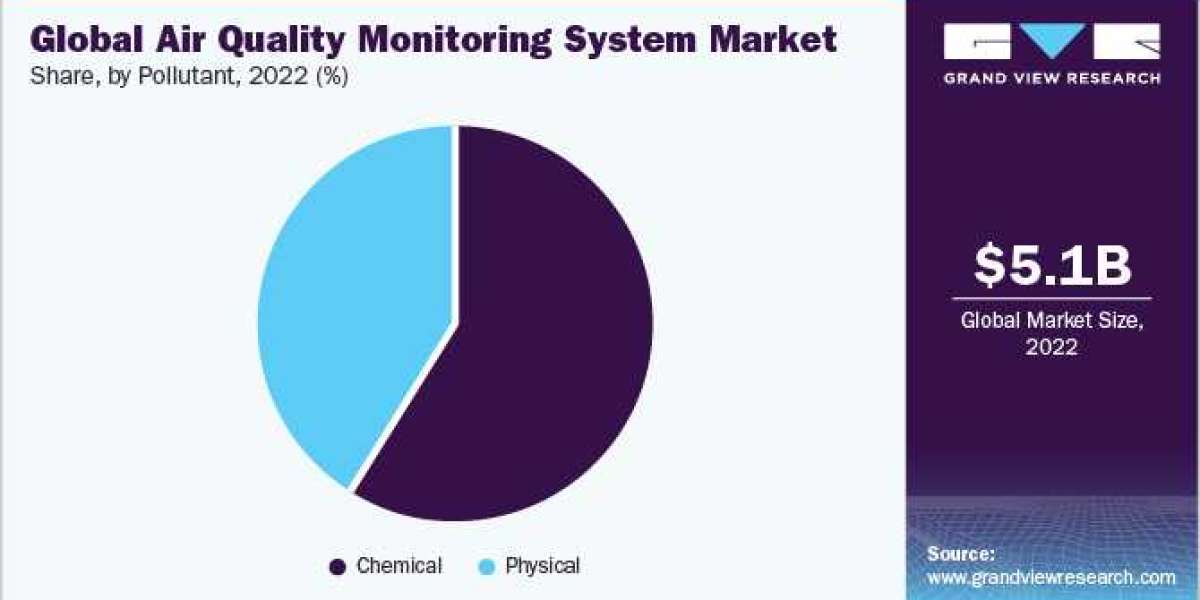

The global air quality monitoring system market size was valued at USD 5.13 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030.

Rising levels of pollutants in the atmosphere and stringent government norms and regulations for monitoring pollution are likely to drive product demand. Moreover, in recent years, casualties have risen significantly due to respiratory diseases resulting from environmental pollution. This is expected to propel product demand subsequently.

Gather more insights about the market drivers, restrains and growth of the Air Quality Monitoring System Market

Air pollution is a major threat to environmental balance. It significantly influences the atmosphere, resulting in acid rain, a rise in toxicity levels, and global warming. Increasing demand for work environment safety is leading to the rising adoption of air quality monitoring systems in manufacturing, automotive, and oil and gas industries. Mishaps such as the Bhopal gas leak disaster and the Aliso Canyon disaster have raised awareness regarding monitoring the presence of pollutants in the atmosphere.

The increasing government initiatives for environmental conservation, such as providing funds for installing air quality monitoring systems and smart city initiatives, are expected to boost market growth over the forecast period. For instance, in November 2022, the U.S. Environmental Protection Agency (EPA) disclosed its allocation of $53.4 million from President Biden's Inflation Reduction Act and American Rescue Plan to support 132 air monitoring initiatives across 37 states. This funding aims to elevate the quality of air quality monitoring in various communities throughout the U.S.

Recent years have seen many tie-ups between government agencies and private organizations. Large companies such as Honeywell International Inc. and Intel Corporation are collaborating with government agencies around the globe to protect the environment. These partnerships aim to develop sensor networks and intelligent systems for monitoring air and water quality. Under the Clean Air Act, the Metropolitan Washington Council of Governments founded the Clean Air Partners in partnership with the Maryland Department of Transportation, Baltimore Metropolitan Council, and WGL Holdings, Inc. Clean Air Partners has deployed monitoring systems across the Baltimore-Washington region and provides current and forecasted air quality data for the area.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

- The global commercial food and biomedical refrigerators and freezers market size was valued at USD 36.69 billion in 2023 and is expected to grow at a CAGR of 5.5% from 2024 to 2030. T

- The global AI video market size was estimated at USD 5.53 billion in 2023 and is projected to grow at a CAGR of 35.3% from 2024 to 2030.

Air Quality Monitoring System Market Segmentation

Grand View Research has segmented the global air quality monitoring system market based on product type, pollutant, component, end-use, and region:

Air Quality Monitoring System Product Type Outlook (Revenue, USD Million, 2017 - 2030)

- Indoor Air Quality Monitoring Systems

- Fixed Indoor Systems

- Portable Indoor Systems

- Outdoor Air Quality Monitoring Systems

- Fixed Outdoor Systems

- Portable Outdoor Systems

Air Quality Monitoring System Pollutant Outlook (Revenue, USD Million, 2017 - 2030)

- Chemical

- Nitrogen Oxides

- Sulphur Oxides

- Carbon Oxides

- Volatile Organic Compounds

- Others

- Physical

Air Quality Monitoring System Component Outlook (Revenue, USD Million, 2017 - 2030)

- Hardware

- Sensors

- Processors

- Output devices

- Software

- Services

Air Quality Monitoring System End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Residential

- Commercial

- Industrial

- Oil Gas

- Manufacturing

- Food Beverages

- Pharmaceuticals

- Healthcare

- Others

Air Quality Monitoring System Region Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- S.

- Canada

- Europe

- UK

- Germany

- France

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Key Companies profiled:

- 3M

- General Electric

- HORIBA Scientific

- Aeroqual

- Emerson Electric Co.

- Seimens

- Merck KGaA

- Teledyne Technologies Incorporated.

- Testo SE Co. KGaA

- Thermo Fisher Scientific Inc.

Recent Developments

- In August 2023, Wayne County intended to initiate a three-year comprehensive program, with a budget of $2.7 million, aimed at installing 100 air-quality monitors. These monitors were planned to be strategically positioned on streetlights and other posts across all 43 communities within the county. The primary objective of this initiative was to monitor and assess the levels of various air pollutants, including nitrogen dioxide, ozone, black carbon, and other particulate matter.

- In April 2022, Oizom introduced its latest advancement: AQBot, an industrial-grade air quality monitoring device focused on a single parameter. This compact and lightweight device has various features, catering to industries and consultants seeking precise monitoring of specific target pollutants. AQBot was unveiled in a webinar that drew an audience of around 250 participants from over 30 countries.

Order a free sample PDF of the Air Quality Monitoring System Market Intelligence Study, published by Grand View Research.