Natural Rubber Procurement Intelligence

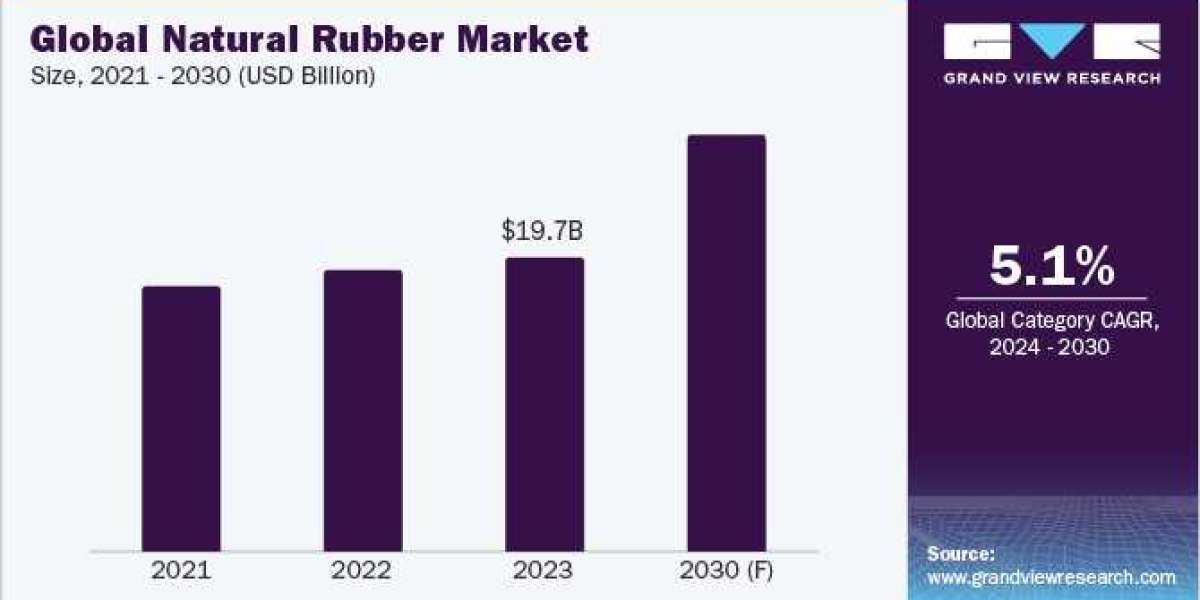

Implementing efficient procurement practices can help companies reduce costs related to sourcing natural rubber. The global market size was estimated at USD 19.73 billion in 2023. The market is driven by rising demand for the category derived from certified sustainable plantations and a shift in consumer preferences toward sustainable products. The increasing applications of this commodity in non-automotive sectors, such as footwear, consumer goods, healthcare, and construction sectors, are also driving the growth.

It is estimated that the total global production of this commodity in 2023 and 2022 was 14.5 million tons each year, compared to 13.8 million tons in 2021. On the other hand, world consumption of rubber (natural and synthetic total) decreased by 2.4% in 2023. In 2023, consumption dropped to 28.8 million tons compared to 29.5 million tons in 2022.

The industry is highly fragmented and competitive. Due to the ease with which buyers can switch suppliers, the latter has limited power to dictate terms or prices. The production and supply chain is dispersed across various regions and countries, especially in parts of Thailand, Indonesia, and Malaysia. The presence of multiple smallholder farmers further contributes to fragmentation. There are more than 6 million smallholder farmers for natural rubbers worldwide. These farmers sell their production to about 100,000 dealers who then forward it to more than 500 factories.

Raw material sourcing, labor, processing (machinery, energy, chemicals and facilities), storage and transportation and others are the major cost elements associated with the production of this commodity. Transportation costs are incurred when raw latex is moved from plantations to processing facilities and finished rubber products are transported to distribution centers or customers. The costs can vary based on the distance traveled, infrastructure, and mode of transportation (rail, road, sea, or air).

Order your copy of the Natural Rubber category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Natural Rubber Sourcing Intelligence Highlights

- The market is highly fragmented. Most of the fragmentation occurs from these specific regions - Southeast Asia, Africa, and South America.

- The bargaining power of suppliers is low due to the increased fragmentation. In recent years, the category has become increasingly commoditized, with very little differences between products offered by different suppliers.

- The threat of new entrants is low in this industry since the cultivation of natural rubber requires access to suitable lands or plantation zones for harvesting, high capital investment for processing facilities and a network of distribution vendors.

- Thailand, Indonesia, Vietnam, India, and China are some of the ideal countries for procurement.

List of Key Suppliers

- Vietnam Rubber Industry Group

- Hevea-Tec (Pirelli C. S.p.A)

- Thai Hua Rubber Company Limited (Guangdong Guangken Rubber Group)

- Sri Trang Agro-Industry Plc

- Tong Thai Rubber Co., Ltd.

- Kuala Lumpur Kepong Berhad

- Thai Rubber Latex Group Public Company Limited

- Hainan Natural Rubber Industry Group Co., Ltd.

- Feltex Co., Ltd

- Enghuat Industries Limited

- Southland Holding Company

- Von Bundit Co., Ltd.

Browse through Grand View Research’s collection of procurement intelligence studies:

- Disposable Medical Gloves Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Loyalty Programs Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Helium Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Natural Rubber Procurement Intelligence Report Scope

- Natural Rubber Category Growth Rate : CAGR of 5.09% from 2024 to 2030

- Pricing Growth Outlook : 3%-8% (Annual)

- Pricing Models : Spot pricing, long term contract pricing, cost plus pricing, market based or competitive pricing model

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Type of natural rubber, production capacity, grades offered, technical specifications, and other operational and functional capabilities

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions