Loyalty Program Category - Procurement Intelligence

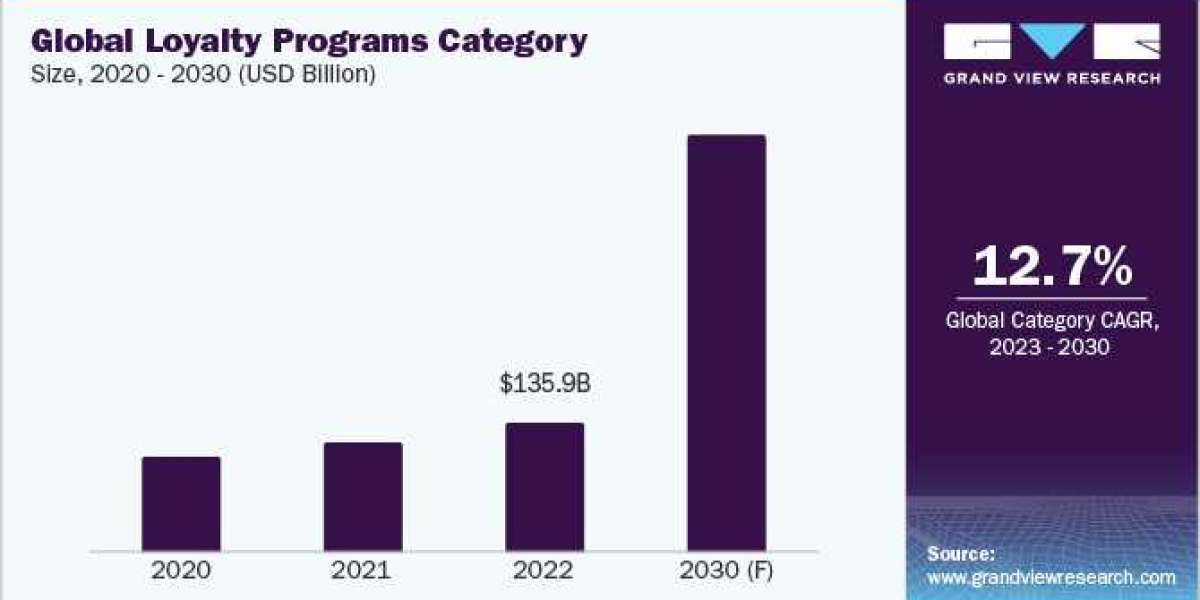

The loyalty program category is expected to grow at a CAGR of 12.7% from 2023 to 2030. Incorporating customer loyalty into a business strategy is crucial. The expense of acquiring new customers is five times higher than retaining existing ones. Numerous businesses achieve customer retention objectives through the implementation of loyalty programs, exploring affiliate-marketing avenues, and providing discounts on a customer's subsequent purchase.

According to Queue.it 2023 report, around 85% of consumers are likely to stay with the brands that offer loyalty programs. Various companies, such as Starbucks, Amazon Prime, Sephora, and DSW, offer loyalty programs in the form of cashback points, card balances, and other benefits on subscriptions. For instance, Starbucks Rewards members can earn stars on every purchase, which can be redeemed for rewards, such as free drinks, food, and others. Similarly, the Sephora Insider Rewards system consists of 1 point equal to USD 1. Thus, the purchase of USD 500 leads to 500 points, which offers a discount of USD 10 on qualified purchases. Such initiatives by companies help them retain customers and increase repurchasing.

The ongoing trends, such as loyalty partnerships, gamification, tiered benefits, and personalization, are anticipated to boost the category growth. Most consumers are likely to purchase from businesses offering personalized experiences. With personalized programs, businesses can use customer data to create an offer appealing to each specific customer. For instance, Marriott Bonvoy offers a variety of premium amenities and benefits based on the number of nights customers spend at the hotel. A gold elite member at Marriott Bonvoy who spends 25 nights per year gets the option of late checkout, room upgrade, and other offers. Enhancing personalization elevates the frequency of positive interactions between brands and customers.

Order your copy of the Loyalty Program category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

The shift towards digital platforms and mobile applications for loyalty programs is a significant trend. Businesses are increasingly adopting digital technologies to enhance user experiences and make participation in loyalty programs more convenient. Creating mobile applications for shopping provides an excellent means to provide a seamless, omnichannel customer experience. Additionally, it simplifies the process of collecting data on the shopping patterns of the customers.

Loyalty Program Sourcing Intelligence Highlights

- Loyalty program operators have established prolonged associations with their service providers, including technology providers and software developers. As a result, such partnerships have enabled loyalty program operators to yield some bargaining power in their transactions

- Establishing a loyalty program requires significant investment in technology, data analytics, and marketing. Existing companies with well-established programs have a competitive advantage. However, new entrants with innovative approaches could still pose a threat

- The category is fragmented as numerous small- and large-scale participants strive to distinguish their services. They achieve this through engagements in partnerships, mergers, and acquisitions with technology companies or various brands

- Staff salaries, IT costs, staff training and management, and marketing costsare some of the costs incurred in providing services.Other costs usually include rent, utilities, and office supplies cost

Browse through Grand View Research’s collection of procurement intelligence studies:

- Loyalty Programs Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Helium Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

List of Key Suppliers

- Ascendant Loyalty LLC

- Kobie Marketing

- Emakina Group

- Gotoclient S.L.U

- Capillary Technologies

- XGate Corporation Limited

- Zinrelo (Velocita, Inc.)

- Exponential Media

- Loyalty Gator Inc.

- LoyaltyLion Ltd.

Loyalty Programs Procurement Intelligence Report Scope

- Loyalty Programs Category Growth Rate: CAGR of 12.7% from 2023 to 2030

- Pricing growth Outlook: 5% - 9% (Annually)

- Pricing Models: Tier-based pricing, subscription-based pricing, competition-based pricing

- Supplier Selection Scope: Cost and pricing, past engagements, productivity, geographical presence

- Supplier selection criteria: Diversified types of programs, end-to-end services, technology-driven services, expertise in the field, multi-channel support, global reach, data privacy regulations, and others

- Report Coverage: Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions