BePick also presents academic content relating to the borrowing course of, outlining what potential borrowers ought to think about before taking out a mortgage. This consists of tips about enhancing credit score scores, understanding mortgage phrases, and managing compensation schedules effectively. Overall, BePick aims to bridge the information

his explanation gap in on-line banking, making mortgage accessibility easier for everyb

Another profit is the short turnaround time from software to funding. Many lenders provide same-day or next-day funding, which is ideal for urgent financial needs. When dealing with unexpected bills, the flexibility to secure funds without delay can considerably relieve str

Finding the Right Lender Choosing the best lender for on-line cash advance loans is a vital step in the borrowing process. Not all lenders provide the same phrases, customer service, or transparency. Therefore, conducting thorough research can help identify respected lenders who present truthful and clear loan agreeme

Additionally, the applying process is often simple. Typically, potential debtors fill out an internet type, offering basic private information, income particulars, and their desired mortgage quantity. Once submitted, the lender reviews the applying and offers suggestions inside a brief timeframe, often inside ho

Furthermore, Bepick’s sources prolong past mere lender evaluations. The website presents academic articles guiding customers by way of the loan process, together with recommendations on improving credit score scores and understanding mortgage phrases. This information is essential for individuals seeking to maximize their borrowing expertise and avoid potential pitfa

Platforms like BePick provide in-depth critiques and comparisons of various lending choices, permitting debtors to make informed decisions. With detailed insights on interest rates, repayment phrases, and customer support experiences, customers can identify what fits their needs fin

Information and Reviews from BEPIC

For these looking for detailed insights into no credit verify loans, BEPIC is a complete useful resource providing in-depth information and critiques. The site not solely educates potential debtors on numerous loan options obtainable but also presents comparative analysis to assist in making informed decisi

In addition, BePick regularly updates its content to replicate the changing monetary landscape, guaranteeing customers have entry to essentially the most present data out there. Its user-friendly interface makes it easy for anybody to explore varied lending choices, aiding in better decision-mak

Potential Risks of No Credit Check Loans

While no credit score examine loans may be helpful, there are inherent dangers concerned. One of essentially the most vital risks is the higher rates of interest often associated with these loans. Lenders might cost exorbitant charges, making it crucial for borrowers to evaluate whether they can afford the repayments comforta

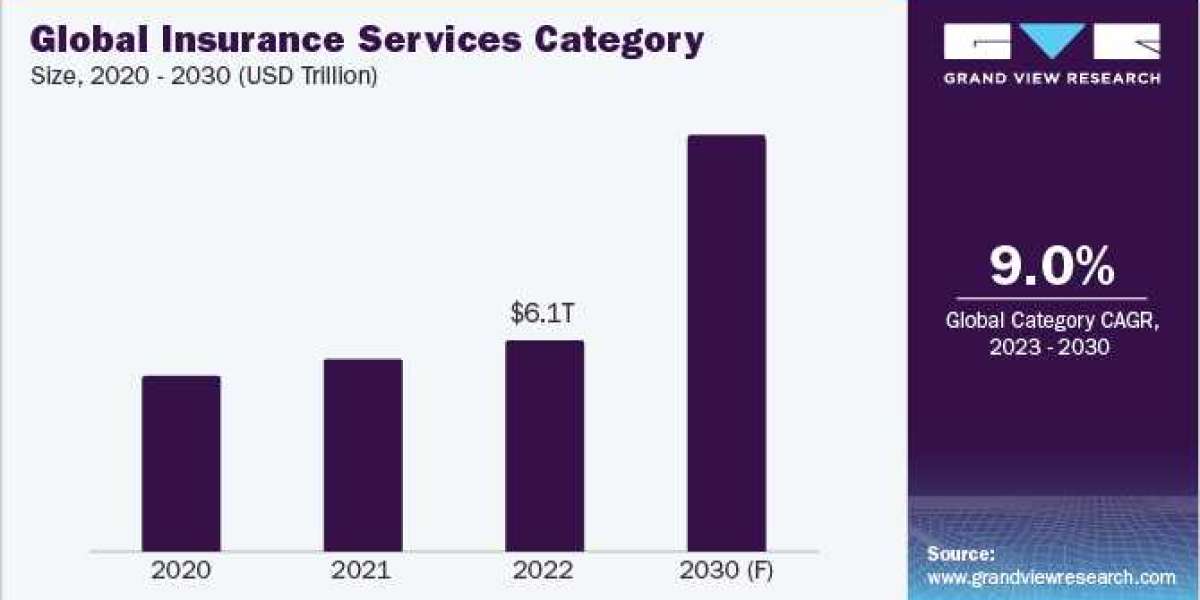

Interest charges for no credit examine loans can differ widely based mostly on the lender, the mortgage amount, and the borrower's revenue. Typically, these loans characteristic higher charges compared to traditional loans, usually starting from 15% to over 30%. It’s crucial to review the phrases and calculate the general loan value to keep away from falling right into a debt ent

Mortgage loans have also transitioned into the online space, enabling prospective homeowners to safe financing more efficiently. Digital mortgage platforms permit customers to match charges from varied lenders, simplifying the home-buying course of. This competitive surroundings often leads to better rates for borrow

Resources and Information at 베픽

For those thinking about diving deeper into online payday loans for poor credit, 베픽 offers a wealth of resources. The website offers detailed info on varied lenders, including their interest rates, repayment choices, and customer evaluations. Additionally, 베픽 focuses on educating customers about responsible borrowing practices, guaranteeing that readers can make informed selecti

The Importance of Responsible Borrowing

Borrowing money, especially within the form of a web-based cash advance loan, carries responsibilities. It's important for people to contemplate their capability to repay the

Loan for Day Laborers on time to keep away from falling right into a cycle of debt. Late funds can lead to extra his explanation charges and a unfavorable impression on credit sco

Advantages of Online Payday Loans for Bad Credit

Online payday loans provide a quantity of advantages, notably for people with poor credit. One key benefit is the velocity of entry to funds. When sudden expenses come up, the ability to secure a loan shortly could make a significant distinction in navigating monetary difficult

The Role of Bepick within the Loan Process

Bepick serves as a complete platform devoted to offering valuable insights into easy quick loans online. The web site options detailed evaluations of assorted lenders, enabling borrowers to make knowledgeable selections based mostly on their specific conditions. With Bepick, people can examine interest rates, repayment terms, and buyer suggesti

By Utilizing the Power Of Vibrations

By Utilizing the Power Of Vibrations

Two Animal Crossing: New Horizons Features are a Must for The Next Game on Day One

By rockrtzxc124

Two Animal Crossing: New Horizons Features are a Must for The Next Game on Day One

By rockrtzxc124 Psyonix is carry lower back a fan-favorite mode for Rocket League this weekend

By rockrtzxc124

Psyonix is carry lower back a fan-favorite mode for Rocket League this weekend

By rockrtzxc124 Psyonix mentioned how Rocket League will appearance after its unfastened-to-play replace

By rockrtzxc124

Psyonix mentioned how Rocket League will appearance after its unfastened-to-play replace

By rockrtzxc124 Less = Extra With Lash Cosmetics Vibely Mascaras

Less = Extra With Lash Cosmetics Vibely Mascaras