Enterprise Resource Planning (ERP) Software Procurement Intelligence

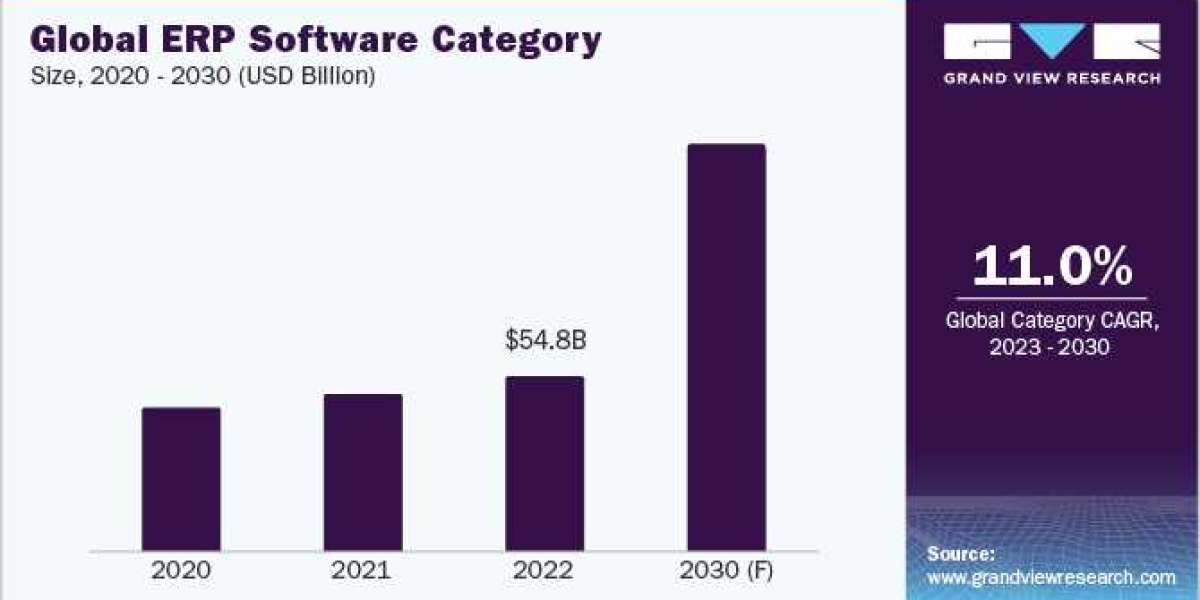

The enterprise resource planning (ERP) software category is expected to grow at a CAGR of 11% from 2023 to 2030. The North American region accounts for the largest share of the category. Growth is being fueled by an increase in the use of mobile and cloud apps, as well as by the demand for operational efficiency and transparency in company operations. According to the Oracle Netsuite 2022 report, businesses keep converting to cloud-based ERP. It also states that to further automate, increase visibility, and improve customer experiences, ERP is merging with other technologies like social media and Internet of Things (IoT) devices. One of the top ERP trends for 2023 is the two-tier ERP. Industrial clouds are gaining prominence steadily. An industry cloud is a combination of infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS), and software-as-a-service (SaaS). Industry clouds are witnessing a significant amount of growth in 2023. They are completely modular and provide the flexibility, inventiveness, and ability to adapt required to suit highly specific industry requirements. All such factors are in turn driving the demand for this category.

There are various reasons why a company could decide to purchase a new ERP system. Increasing productivity, enhancing business intelligence through better data gathering and analysis, accelerating the order-to-cash cycle, and reducing labor expenses are the most common reasons. To justify the ERP cost, the company must meticulously consider the features and modules it requires, and the financial value it anticipates the ERP will provide. Smaller businesses are increasingly using the SaaS model due to its flexibility and potential for growth. A small business is not required to make a significant upfront investment in infrastructure or license fees since this approach uses cloud-based hosting. To provide flexibility and scalability, the subscription-pricing model depends on the number of users or the volume of transactions. There are fewer upfront costs because there is no requirement for on-premise hardware extension.

Order your copy of the Enterprise Resource Planning (ERP) Software category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

After reaching a low in the final quarter of 2022, software mergers and acquisitions are steadily increasing in 2023. The number of technology-related deals increased by 23% between Q1 and Q2 2023 compared to the same period in 2022. For instance,

- In June 2023, Fresenius SE Co., a global healthcare company announced a partnership with SAP. With the help of SAP SE's comprehensive RISE with SAP solution, the company successfully moved its important SAP software systems to the cloud. The migration involved a wide range of technologies, including CRM and ERP systems for key company operations in manufacturing, finance, supply chain, and procurement.

- In January 2023, as part of the modernization of its ERP Baan solution, Netherlands-based, VDL Enabling Technologies Group entered a partnership with Infor. In this high-tech cluster of the VDL Group, VDL ETG announced the implementation of Infor CloudSuite Industrial Enterprise as its ERP system. The move to the cloud enabled the integration of the core production processes, financial and business administration, as well as various other components.

- In January 2023, BMW Group announced a strategic partnership with SAP. The BMW Group would migrate its complete SAP software landscape using the RISE with SAP solution. To enable cooperative innovation for crucial business areas including finance, parts supply, warehousing, supply chain, and production, the company will integrate its cloud strategy with its current SAP S/4HANA systems.

- In March 2022, Epicor announced the acquisition of Grow Inc., which offers BI capabilities across many industries. The acquisition enhanced and broadened the analytical capabilities offered by Epicor.

Enterprise Resource Planning (ERP) Software Sourcing Intelligence Highlights

- The global ERP software category is fragmented with the presence of many leading international and regional companies. Due to the rapid use of the cloud and SaaS-based pricing models, there is a significant push toward the fragmentation of ERP software

- There is intense competition between the ERP software providers as there is a huge demand for alternatives to dominant large-scale vendors (such as Oracle, SAP, Infor, etc.). The number of suppliers in this category is steadily growing as new vendors concentrate on emerging sectors like employee engagement and financial planning

- Development is the largest cost component in this category, accounting for almost 50% - 60% of the total costs, followed by the costs of data transfer, and labor.

List of Key Suppliers

- Infor Inc.

- Epicor Software Corporation

- IBM

- HP Enterprise

- Microsoft Corporation

- NetSuite Inc.

- Oracle Corporation

- Sage Group, plc

- SAP SE

- Unit4

- Workday

- ServiceNow, Inc.

- QAD Inc.

Browse through Grand View Research’s collection of procurement intelligence studies:

- Disposable Medical Gloves Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Loyalty Programs Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Helium Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Enterprise Resource Planning (ERP) Software Procurement Intelligence Report Scope

- Enterprise Resource Planning (ERP) Software Category Growth Rate : CAGR of 11% from 2023 to 2030

- Pricing Growth Outlook : 8% - 12% (Annually)

- Pricing Models : Licensing-based, subscription-based, usage-based, and tier-based pricing model

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : By cloud deployment type, features (financial management, reporting and dashboards, supply chain management, customer relationship management, and others), operational capabilities, quality measures, technology, certifications, data privacy regulations, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions