Translation Services Procurement Intelligence

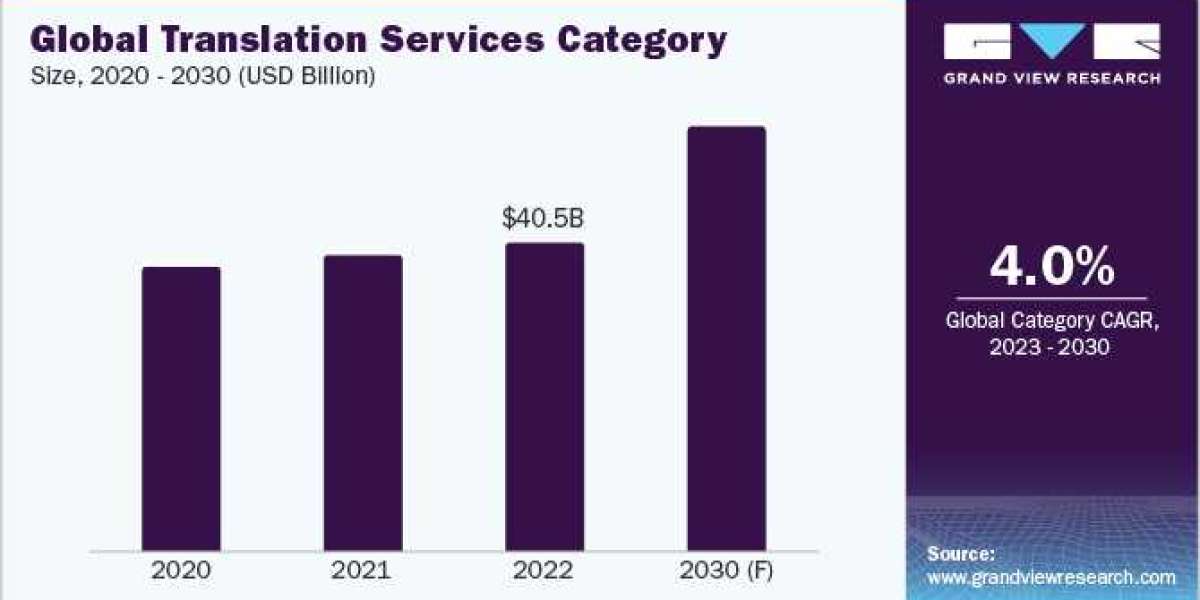

The translation services category is expected to grow at a CAGR of 4% from 2023 to 2030. The two main sub-divisions include human-assisted translations and machine translations. Neural machine technology (NMT), which is still in the developing phase, is one of the major technologies in machine translation. The advent of neural machine translations has allowed companies to see the potential value this technology can offer-such as a better understanding of the nuances of languages, idiomatic expressions, and cultural references. NMT-based translation can reduce enterprise translation costs by more than 75%. Technology giants such as Google, Microsoft, Amazon, and Salesforce have started the implementation of NMT in their platforms.

Multimodal and augmented reality translation is another upcoming technology trend. An example of how augmented reality (AR) technology can be used while traveling is to view translated information about landmarks and menus, and even have real-time conversations with locals through AR glasses or smartphone applications. AR translation is anticipated to revolutionize how consumers explore foreign places and interact with foreign cultures.

The supplier landscape can be divided into local, regional, and global. Regional translation markets mostly operate out of translation agencies. Typical clients of these services include medium-sized organizations that seek to enhance their governance power and require a more robust and streamlined process that provides them with greater control over their operations.Asian, African, and Latin American economies are developing at a rapid pace, which has increased demand for languages like Mandarin, Hindi, Arabic, and Portuguese. Localization, medical and law translation (specialized), transcreation, and remote interpreting are a few examples of emerging areas in translation. For instance, English is one of the top 10 languages considered for website localization followed by Chinese, Spanish, and Arabic. This, in turn, reflects a move toward international digital communication.

Order your copy of the Translation Services category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Translation Services Sourcing Intelligence Highlights

- The translation services category is highly fragmented. A mix of website, interpretation, machine, and/or audio/video translation service providers make consolidation a challenge in this industry. As a result, the bargaining power of suppliers is reduced.

- Some of the highest-paying translation languages in 2022 were German, French, Arabic, Dutch, and Chinese.

- The largest cost components are the salaries of different translators or interpreters in combination with the technology and software required.

- Under translation services sourcing, Singapore, Netherlands, Denmark, Sweden, the U.S., the UK, China, and India are the most preferred countrie

List of Key Suppliers

- TransPerfect Global, Inc.

- Lionbridge Technologies, Inc.

- LanguageLine Solutions (Teleperformance SE)

- Semantix

- Welocalize, Inc.

- Lingotek, Inc.

- Yamagata Corporation

- RWS Group

- Argos Translations Sp. z o.o.

- Keywords Studios Plc

Browse through Grand View Research’s collection of procurement intelligence studies:

- Disposable Medical Gloves Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

- Loyalty Programs Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement Operating Model, Competitive Landscape)

Translation Services Procurement Intelligence Report Scope

- Translation Services Category Growth Rate : CAGR of 4% from 2023 to 2030

- Pricing Growth Outlook : 10% - 15% (Annually)

- Pricing Models : Volume (words)-based, hourly rate, cost plus, and competitive pricing model

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Localization and types of translation services, AI or proprietary platforms, marketing or legal translation, e-learning translation, software localization services, DTP and other services, operational capabilities, quality measures, certifications, data privacy regulations, and others

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions